Want to Quit Accounting? Reassess Your Success

Being an accountant or CPA in private practice has just become too hard for many folks and if you are one of them, I can completely empathize with you, because I have been there, too.

There was a time in my career when I was in a really toxic business partnership. To save my soul and my sanity, I had to leave it. While it was the right thing to do mentally, emotionally, and professionally, it was definitely deeply demoralizing and financially very challenging.

It was through this negative experience, however, that I was able to really dig into what my purpose and passions are and emerge from the process a better accounting professional. I also added a CPA designation and a Certified Fraud Examiner(CFE) credential to my accomplishments and abilities to help clients and to be a happier, more focused human being.

Use COVID and Tax Season Challenges to Reassess Your Success

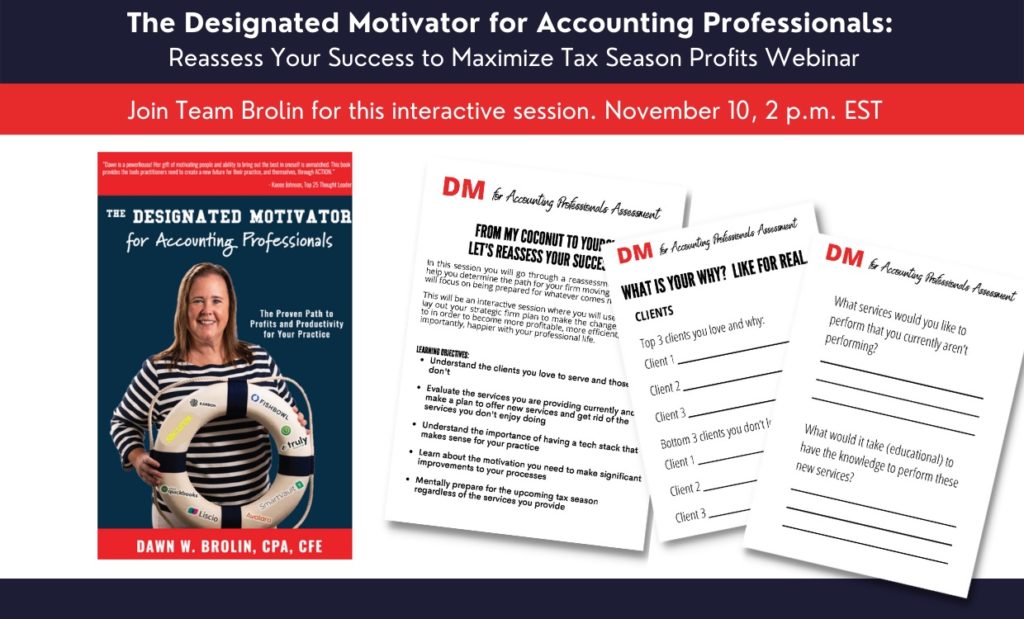

What is clear to me is that it was only by “being down” that I was able to assess where I was and make a plan for where I wanted to go, rising up again. I now call this process “Reassess Your Success” and it’s detailed in The Designated Motivator for Accounting Professionals, the book I recently wrote about my experiences, and the advice I have to offer along with many other accounting professionals, to help you forge a path that is better for you today and long into the future.

The reason I feel so passionately about the process related to Reassess Your Success is because it’s exactly what I did to get to where I am today. It’s a pretty good place, actually.

My family is thriving, my practice is profitable and growing, and I have the right technology infrastructure and tech stack in place to maximize my efficiency. This means I can work less and make more money (and I do).

To be clear, it wasn’t always this way for me and my practice. If you are feeling any kind of practice pain or disempowered personally, it can be helpful to know that you are not alone. Many accounting professionals — myself included — have struggled with our businesses.

I think it is especially important to keep this in mind as we head toward another tax season, having just “finished” the COVID Crusher as I refer to it. From PPP loans to the IRS changing their rules every five minutes (and making us wait forever on the phone to resolve client issues) to having to figure out how to shift operations and manage client stress, this has been a rough two years to say the least.

Now, faced with tax season 2022, there are many professionals whom I have talked with who are really questioning whether the stress of another “Treadmill Tax Season” is worth it. This is a question that only you can answer.

However, it is certainly much easier to do it with a community around you to support you. My initial advice is this: If you are facing an adverse business situation, try to keep your view about it in perspective and remember that life is too short to be miserable or to allow yourself to be treated unprofessionally and in a mean way. Surrounding yourself with people who truly care, support you, and lift you up is better than any penny you will ever make.

Manage Tax Season Stress by Treating Your Practice Like an Etch-A-Sketch

For me, every day I start anew in my practice and my life. When the sun rises, I am thankful for another opportunity to use the DM Philosophy and my own internal motivation to help others take action to improve the areas they feel need it most.

I hold myself accountable for doing all that I can to tap into my natural gifts and the skills I have developed to help myself and others maximize personal and professional potential.

Although it’s easy to get caught up in the short-term stress of your practice, I find that taking a long-term view of my goals really helps too. I take things one day at a time. I think of my business like an Etch-a-Sketch toy. Every day you try to create a masterpiece, then you shake it clean and, if you’re lucky, you have the opportunity to take up the battle again the next day. This approach helps me stay motivated and clear on my goals.

Final Thoughts

So, as your DMA, I want to leave you with two questions:

- Do you know what your goals are for your life and your practice at a granular level?

- Do you have them written down and do you refer to them each day to keep you motivated and on track?

If you don’t, don’t worry, you aren’t alone. The vast majority of business owners (and accounting professionals) don’t have them written out or even clear in their heads.

The point being here, if you aren’t clear on your goals, how can you possibly reach them? Failing to do this makes it very difficult (if not impossible) to succeed.

The Designated Motivator for Accounting ProfessionalsFor many accounting professionals, the feeling of being overwhelmed became our new normal, and that’s not the way anyone should live. Join Dawn Brolin, CPA, CFE in her Designated Motivator webinar on Nov. 10, 2p EDT. She will offer help, hope and a practical playbook of the psychology, business strategies, and technology solutions for you to succeed in this profession and as a practice owner. All attendees will receive a Free Copy of her new Designated Motivator for Accounting Professionals book. |