Tax data reveal firms shifting profits and paying lower rates

Global companies are benefiting from a prolonged decline in tax rates and continue to shift profits between jurisdictions to further cut their bills, new data from the OECD showed.

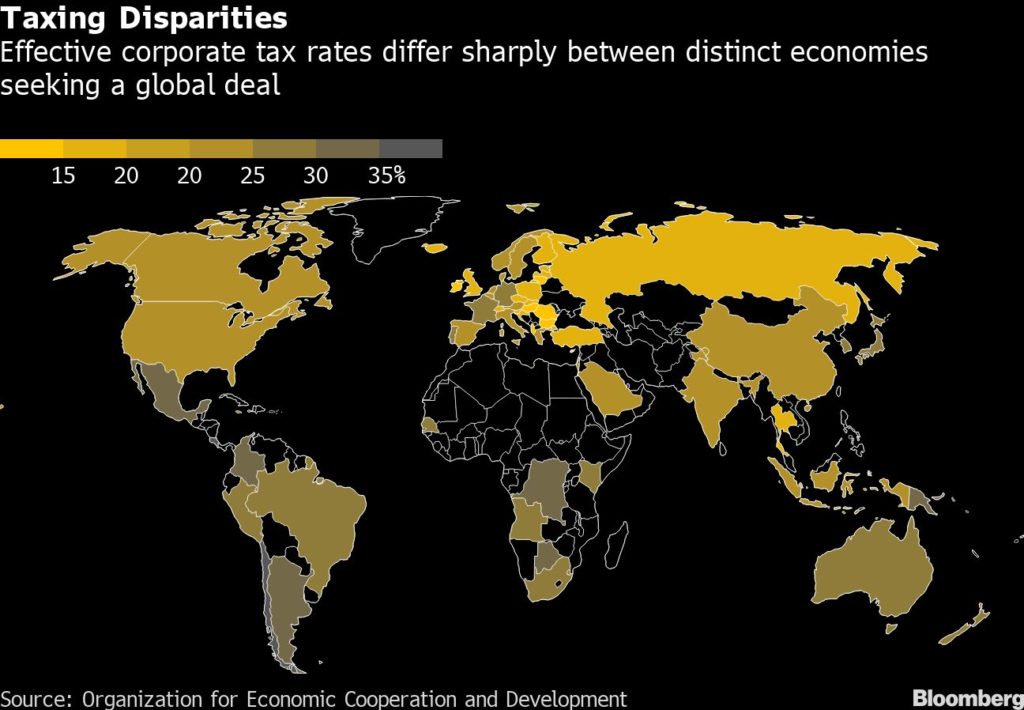

In its annual update of a database designed to help governments analyze tax flows and make firms pay their fair share, the Paris-based organization found that corporate rates in the last 20 years have fallen in 94 of the 111 countries and territories it monitors. Meanwhile, its statistics showed disparities between the location where multinationals report profits and where economic activity actually occurs.

The findings add pressure to conclude years-long negotiations to change the tax rules for globe-trotting firms and end a race between governments to attract investment with lower and lower rates.

The OECD-led talks between more than 130 countries accelerated this year after the U.S. made proposals to break a deadlock on how to treat mainly American tech firms. The COVID-19 pandemic has also provided fresh impetus as nations seek new revenues to finance the cost of propping up their economies through lockdowns.

Yet while Group of 20 countries approved an overview of the plan earlier in July, there are still disagreements over the details of the new system. If solutions can be found in time for international meetings in October, new rules could come into force as soon as 2023 to make companies pay more tax in the countries where they operate and create a global minimum rate.

“Evidence of continuing base erosion and profit shifting behaviors as well as the persistent downward trend in statutory corporate tax rates reinforce the need to finalize agreement and begin implementation,” the OECD said.

The database published Thursday showed the average statutory tax rate fell again in 2021 to 20%, the latest step in a downward trend since the 28.3% recorded in 2000. In most cases, the OECD calculates companies pay an even lower effective rate, accounting for different incentives and rates governments offer for types of activity or income.

There are also broad variations within those effective tax rates, from less than 15% in countries including Ireland, Hungary and Cyprus, to more than 25% in France, Germany and Japan.

The OECD publication also presented country-by-country statistics showing financial and economic activities of around 6,000 multinationals. The aggregated and anonymized data set, which governments agreed to contribute to in 2015, showed that companies report a high share of profits in investment hubs compared to employees and tangible assets.

“The new statistics suggest continuing misalignment between the location where profits are reported and the location where economic activities occur,” the OECD said.