Tax Fraud Blotter: Caveman con

Hundreds of occasions; now for the hard labor; fool me twice; and other highlights of recent tax cases. Scranton, Pennsylvania: Tax preparer Donald Royce, 46,

The latest information from our Accountants

Hundreds of occasions; now for the hard labor; fool me twice; and other highlights of recent tax cases. Scranton, Pennsylvania: Tax preparer Donald Royce, 46,

The Internal Revenue Service unveiled a long-awaited online portal Wednesday where businesses will be able to file their 1099 information returns for free. The Information

The licensing debate; IRIS AWOL; donating crypto; and other highlights from our favorite tax bloggers. All in the preparation National Association of Tax Professionals (https://blog.natptax.com/):

KPMG is expanding its efforts to attract more students to the firm and the accounting profession at large, partnering with the University of Northern Iowa

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a

Tax departments are often forgotten as a big data consumer. To get a sense of what large companies deal with, just take a minute to

The Public Company Accounting Oversight Board is on the receiving end of a lawsuit filed by a civil liberties group for penalizing an unidentified accountant.

“Never spend your money before you have earned it,” Thomas Jefferson cautioned. It’s good advice for corporate America, but only if companies know where the

The Securities and Exchange Commission is weighing a proposed rule to require publicly traded companies to provide climate-related disclosures. Technically it wouldn’t apply to privately

The Internal Revenue Service’s Criminal Investigation unit is increasingly relying on information provided by financial institutions under the Bank Secrecy Act to uncover tax-related crimes

Treasury Secretary Janet L. Yellen will soon need to use accounting maneuvers to keep the United States from defaulting on its debt.

The Internal Revenue Service could be doing more to detect and deter promoters of abusive tax schemes, according to a new report. The report, released

The first smartphones were released in 2007, and only 15 years later, we have phones that can do much more than simple calls and text

The average effective tax rate of profitable large corporations fell from 16% in 2014 to 9% in 2018 after passage of the Tax Cuts and

The Forvis building in Springfield, Missouri Courtesy of Forvis Forvis, New York, announces a collaboration with Jupiter Intelligence, a provider of climate risk analytics for

SAP is deepening its strategic partnership with Amazon Web Services, which will see the two companies collaborating on significant operational matters. The deal centers around

Government mandates may require taxpayers to do their taxes, but that doesn’t mean they have to do them with you. As the start of tax

Victims of storms in California now have until mid-May to file various federal individual and business tax returns and make tax payments. The IRS is

How do you get remote workers to take cybersecurity seriously? There’s coaching and coaxing, sure, but there’s also just scaring the holy living heck out

Allen Weisselberg, who oversaw the finances at Donald Trump’s companies for decades, will immediately head to jail Tuesday after being sentenced to five months for

Sax LLP, a Top 100 Firm based in Parsippany, New Jersey, has merged in Schall & Ashenfarb CPAs, a firm based in New York City,

Opinions expressed by Entrepreneur contributors are their own. Imagine this. John Carter begins his job as the country club’s new finance and administration director by

The Internal Revenue Service said Friday it recently completed making final corrections to the tax year 2020 accounts for taxpayers who overpaid their taxes on

Approved with unanimous bipartisan support from the Montana Legislative Audit Committee in December, a new bill would tighten state auditing rules, including adding penalties for

Nonfarm payrolls increased by 223,000 in December and the unemployment rate ticked downward by two-tenths of a point to 3.5%, the U.S. Bureau of Labor

The new year brings a new tax season and the opportunity to advise clients on ways to save money on their taxes. Roth IRA conversions

Citrin Cooperman, a Top 25 Firm based in New York, has added Chapman Bird & Tessler in Los Angeles, the fourth deal in the past

Hourly earnings growth slowed last month to its weakest level since March of last year, according to a report released Tuesday by the payroll company

This includes a will and the accompanying documents, a buy-sell agreement if you are in a partnership, a practice continuation agreement if you are a

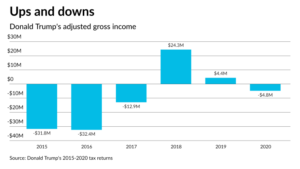

Massive losses and large tax deductions in Donald Trump’s returns reveal how the former president was able to use the Tax Code to minimize his

© Scott M. Aber, CPA, PC