How the Tax Court Upholds IRS Employment Choices

In three previous columns, I discussed often-overlooked IRS tax breaks available in 2021 for freelancers, consultants and other self-employed individuals who pay their sons and

The latest information from our Accountants

In three previous columns, I discussed often-overlooked IRS tax breaks available in 2021 for freelancers, consultants and other self-employed individuals who pay their sons and

To succeed in today’s disrupted business environment, finance teams need to consider all of their untapped sources of value. Thriving in highly changeable market conditions

Do you agree to everything asked of you because saying “no” feels uncomfortable? As you spread yourself too thin or agree to work outside of

Two previous columns discussed often-overlooked tax breaks available in 2021 for freelancers, consultants and other self-employed individuals who pay their sons and daughters reasonable wages

The Internal Revenue Service has created the position of chief taxpayer experience officer to boost efforts across the agency to better serve taxpayers. Ken Corbin,

Deloitte and its Deloitte Foundation announced that a student team representing Truman State University won its 2021 Deloitte FanTAXtic national case study competition, giving the

You may disagree with a situation at your firm behind closed doors, but as a leader you need to be part of putting on a unified front.

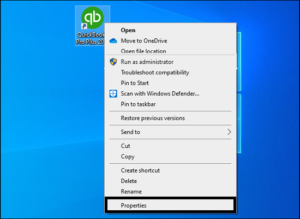

When updating QuickBooks payroll, you may receive QuickBooks Error 15101 that usually appears when QuickBooks is unable to connect to the internet to download the

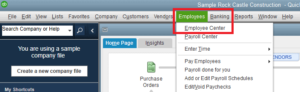

QuickBooks Payroll allows you to handle multiple Payroll chores without any complications. Paying your employees on time is a healthy business practice and any delay

This series of frequently asked questions (FAQs) provides answers to questions we are hearing from our members about the centralized partnership audit regime under the

The Securities and Exchange Commission tapped deputy chief accountant Paul Munter to become acting chief accountant when chief accountant Sagar Teotia leaves in February. Teotia

The Treasury Department said Friday it plans to launch an all-out effort to deliver Economic Impact Payments to people who haven’t yet received the two

The U.S. Supreme Court announced in March 2020 that it will hear a case that challenges the constitutionality of the individual mandate under the Patient

The Securities and Exchange Commission formally adopted amendments in November to modernize financial disclosure requirements to ease the compliance burden for SEC registrants and make

Nearly 30% of small business owner’s overpay their taxes every year to the state and federal tax authorities either because of the incorrect tax payment

Many employees previously working physically in one state now find themselves working remotely from another, as COVID-19 continues to increase the pace at which the

The new capabilities in CCH Client Collaboration were developed specifically to save firms and clients time during a busy tax season and to reduce overall tax filing

Real estate investors have much to consider when deciding how to structure their businesses. From legal considerations to tax implications, these entrepreneurs face some unique

This series of frequently asked questions (FAQs) provide guidelines for tax practitioners to consider when preparing a written document retention policy for their firm. Additional

Despite the tax law change, the key principles remain relevant today. In the new case, a Maryland taxpayer had an insurance consulting business. He claimed

I understand that there are firms out there that haven’t yet embraced apps or the cloud quite like I already have. So, I want to share with you

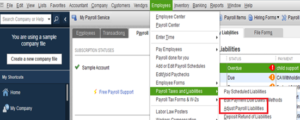

It is not unusual to find a miscalculation or error in scheduled payroll tax liabilities in QuickBooks. Even a minor mistake while setting up payroll

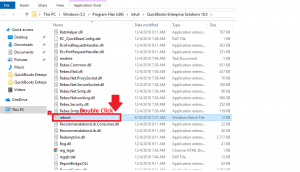

Today in this article, we are going to discuss QuickBooks Error 15106, which is one of the most common 15XXX series of errors that affects

Stop paying accountants when you can just use QuickBooks. Free Book Preview Tax and Legal Playbook Get game-changing solutions to your small business questions. January

Payroll is an essential feature of QuickBooks accounting software and irrespective of the size and nature of a business, it ensures smooth and uninterrupted payroll

If you are a QuickBooks user who manages online banking from within the QuickBooks Desktop application then sooner or later you will require to merge

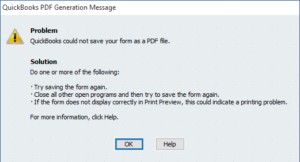

QuickBooks Save as PDF not working is a common issue reported by users. When you update to Windows 10 and prompt QuickBooks to generate PDFs

From accounting to personal finance, learn how to manage money smarter. Free Book Preview Money-Smart Solopreneur This book gives you the essential guide for easy-to-follow

Know your math like Jerry Selbee, and you can beat the system. Free Book Preview Money-Smart Solopreneur This book gives you the essential guide for

December 10, 2020 8 min read Opinions expressed by Entrepreneur contributors are their own. This article was written by Mitchell Terpstra, a member of the Entrepreneur NEXT

© Scott M. Aber, CPA, PC