Tax Fraud Blotter: Fallen angels

Could be a long haul; Boston illegal; down the drain; and other highlights of recent tax cases. East Providence, Rhode Island: Michael Chaves, owner of

The latest information from our Accountants

Could be a long haul; Boston illegal; down the drain; and other highlights of recent tax cases. East Providence, Rhode Island: Michael Chaves, owner of

The IRS has now clarified some of the rules relating to the extension in Notice 2021-21 (IR-2021-67, 3/29/21). Background: The normal tax filing due date

The I.R.S. believes the American drugmaker used an abusive offshore scheme to avoid federal taxes.

In my previous article on keeping data secure while working remotely, I covered steps to take to ensure your devices and those of your employees

2017 was almost over when Congress approved and then-president Donald John Trump signed the TCJA, short for the Tax Cuts and Jobs Act. Both its

New updates from Intuit and the QuickBooks team this month include QuickBooks Cash coming to QuickBooks Online Accountant, a payroll insights dashboard, simplified search within

The Internal Revenue Service said Wednesday it plans to take steps to automatically refund money starting in May and continuing through the summer to taxpayers

As tax season approaches, here’s how to know if you should seek out an expert to help you navigate the numbers.

Issues with clients often happen, but when it becomes disruptive to a positive working relationship, it is usually best to move on and hopefully amicably.

Greensill Capital promised a win-win for buyers and sellers, until it all fell apart, igniting concerns about opaque accounting practices.

Attend this free webinar and learn how to streamline processes, maximize efficiency, and increase profit. Franchise Your Business Schedule a FREE one-on-one session with one

Get a better grasp on your company’s finances and help master the financial side of your business. Free Book Preview Money-Smart Solopreneur This book gives

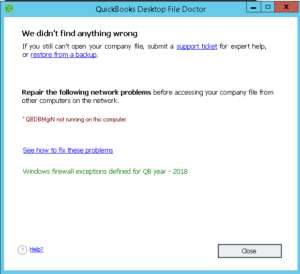

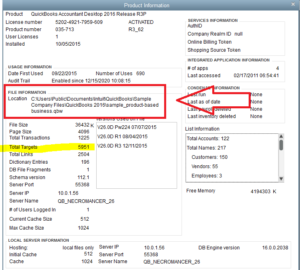

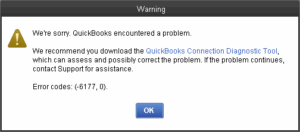

Intuit has released different tools for better user experience, and QuickBooks Database Server manager tops the list. When you connect to QuickBooks DB Manager, multi-user

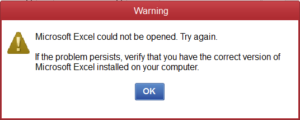

QuickBooks is a useful tool for small and midsize business owners who come from a non-accounting background. It can integrate with otherworldly office applications and

QuickBooks is an Intuit developed accounting software that is capable of handling the financial data of small to mid-sized businesses. To cater to the needs

If you are unable to use QuickBooks because of some issues with QBDBMgrN (QuickBooks Database Server Manager) service then you are not alone, several QuickBooks

My relationship with him is the most positive one I’ve ever had with a man over money.

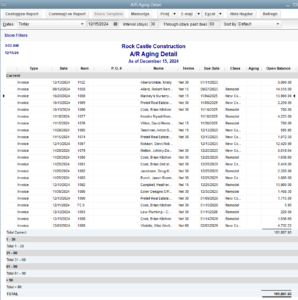

Bad debt is the amount that a business or a company is unable to recover from the debtor in case the borrower has gone bankrupt

QuickBooks Multi-user mode is a feature inbuilt into QuickBooks and has aided a lot of businesses on working with the application. As the name suggests,

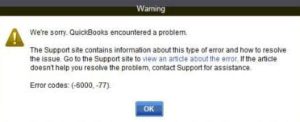

One of the most common error user usually faces is QuickBooks error 6177 0. Whenever you create a new company file in QuickBooks, it gets

If your network have been set up incorrectly, then you may face QuickBooks error 6144 82. The error appears when a user tries to run

QuickBooks has from time and again has worked to solve the issues that may arise in its software and one such error reported quite often

In many cases, a QuickBooks user might want to merge two QuickBooks company files into one, but unfortunately, the feature to merge two QuickBooks files

This 10-course bundle is taught by a CPA. Free Book Preview Tax and Legal Playbook Get game-changing solutions to your small business questions. February 15,

Stop spending on accountants when you can be one yourself. Free Book Preview Tax and Legal Playbook Get game-changing solutions to your small business questions.

The COVID-19 pandemic and the lockdowns have affected some businesses far more than others. Restaurants are a good example. At one point, they were closed.

For most of us, the last 12 months have been a rollercoaster, a fast-track MBA in change management and and definitely an era with a steep

The Internal Revenue Service is clarifying its guidance on provisions of the coronavirus relief legislation that provide tax credits to employers offering paid sick leave

As a fresh round of federal relief loans is getting distributed to U.S. small firms hit by a pandemic crisis that will soon stretch to

Senators and House members introduced legislation to help taxpayers survive the pandemic, with tax credits for developers revitalizing homes in “distressed” neighborhoods and enabling small

© Scott M. Aber, CPA, PC