IRS starts refunds for tax returns claiming unemployment benefits

The Internal Revenue Service is starting to provide tax refunds to taxpayers who paid taxes on their 2020 unemployment benefits that recent legislation later excluded

The latest information from our Accountants

The Internal Revenue Service is starting to provide tax refunds to taxpayers who paid taxes on their 2020 unemployment benefits that recent legislation later excluded

In response to the recent fuel crisis, the IRS has just indicated it will not impose a penalty when dyed diesel fuel is sold for

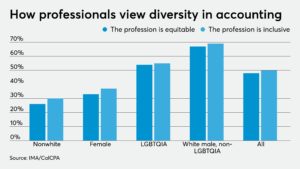

The accounting and finance profession is having trouble retaining employees from different racial, ethnic and gender backgrounds, but there are some strategies organizations can use

While many accounting firms are talking about client experience, very few have any idea how to approach improving it. As a result, they tend to

Remember Blockbuster Video? It wasn’t so long ago that Blockbuster dominated the video rental space with 9,000 stores worldwide and close to $6 billion in

We teach webinars very often about improving firm efficiency, workflow and providing better services for our clientele. No matter what the subject matter of the webinar

Garret Layman BKD, St. Louis, released the new tool BKDpulse, a dashboard suite enabling college and university leaders to assess how their institution’s financial metrics

The Consolidated Appropriations Act 2021 (CAA 2021), which was passed on December 27, 2020, provides many of the answers the country was waiting for regarding

The Internal Revenue Service has clarified that dependent care benefits that are attributable to carryovers or have an extended period for incurring claims generally are

In a new private ruling (PLR 202114001, 1/12/21) the IRS substantially limited write-offs for IVF costs claimed by a same-sex couple that used an unrelated surrogate.

Financial executives are eyeing tax changes expected in the Biden administration, demands for more environmental, social and governance reporting, and diversity efforts. A new survey

When I say the words “unreasonable and demanding,” chances are, a client – either past or present – just sprang to mind. After all, everyone

The American Institute of CPAs wants the Internal Revenue Service and the Treasury Department to help businesses facing foreign trade obstacles to maintaining inventory during

Our topic is exclusion from taxable income for employer payments that would otherwise be included in the W-2 (Section 129). The savings can be in

The Internal Revenue Service is having a hard time hiring enough staff to help it get through this year’s extended tax season and overcome its

Brian Kolfage, whose work with Stephen Bannon to raise money for a U.S.-Mexico border wall resulted in a federal fraud indictment last year, faces new

RSM US, a Top 10 Firm based in Chicago, is buying Rego Consulting’s ServiceNow workflow automation practice and plans to combine it with RSM’s own.

The Sustainability Accounting Standards Board is readying more standards as it prepares for an upcoming merger, while the Securities and Exchange Commission increasingly focuses on

Hiring is no longer limited by physical location. By leveraging technology, we can expand our teams to include people from different geographical locations, broaden our

I often receive queries from freelancers, consultants and other kinds of self-employed individuals who use their homes to run their businesses and ask how to

The House Ways and Means Committee approved bipartisan legislation Wednesday to expand automatic enrollment in 401(k) plans, expand a tax credit for small-business startups and

In a new Tax Court case, Max, TC Memo 2021-37, 3/29/71, a clothing manufacturer could not claim the R&D tax credit for its process of

Photo: David A. Brown Bill.com and Square have partnered with the San Francisco Chamber of Commerce, the Black Chambers of Atlanta and the regional economic

Ford Baker, CPA, founded the BaCo Group in 1999. For 20 years, he grew his firm, hired staff, and expanded his expertise. In 2020, a new need emerged. After developing an accounting workflow technology

The Center for Audit Quality released an alert Monday discussing the audit considerations surrounding a private company entering the public markets through a merger with

Tax day was extended one month and two days this year to May 17, 2021. But that doesn’t mean the job will be any easier

After transitioning most of their workforces to operate remotely for the past year, accounting firms now face the decision of if and when to have

QuickBooks, with all its features, functionality, and variety, is not free from errors or bugs. A lot of the time, QuickBooks hangs or freezes, and

It’s rare that we get to call out the achievements of our own writers or any individual in the world of tax and accounting, for that

The Small Business Administration will begin accepting applications Monday for a new program to help hard-hit restaurants reopen during the pandemic, and some firms are

© Scott M. Aber, CPA, PC