Try These Pro Tips to Fix Sage Error 1603

Sage is a world-class software used by hundreds and thousands of small to medium-sized businesses to carry out their various accounting and taxation needs. However,

The latest information from our Accountants

Sage is a world-class software used by hundreds and thousands of small to medium-sized businesses to carry out their various accounting and taxation needs. However,

President Joe Biden issued his first full budget proposal Friday, detailing his ambitions to dramatically expand the size and scope of the federal government with

A crook named Kusok; more holes than a Swiss cheese; anti-social media; and other highlights of recent tax cases. New York: International fugitive Anton Bogdanov,

Avalara, Inc., a provider of automated tax compliance tools and services for businesses of all sizes, has released an array of new tax compliance products

Question. Julian, hello from “Patrick.” That’s not really my Christian name, and I’d as soon skip my last name. How come? Because, like lots of

The Internal Revenue Service disbursed more than 1.8 million additional Economic Impact Payments totaling over $3.5 billion under the American Rescue Plan in the past

Accountant-focused file-sharing and mobile client app maker Liscio is now integrated with practice management tools maker Karbon. With Liscio and Karbon working together, staff will no

The Securities and Exchange Commission wants input from accountants on rules it is developing for disclosing climate risks and environmental, social and governance reporting. SEC

In the second article in this series, we looked at how we can help our “unreasonable and demanding” clients become less so by alleviating their

If you’ve attempted to budget without success, it’s time to give the cash-only approach a try. Free Book Preview Entrepreneur Kids: All About Money Submit

As part of our ongoing effort to address reader questions on issues that impact their professional lives, or that of their clients, we established our

Continuing education courses can sometimes put accountants and tax professionals to sleep, but a new breed of e-learning is making the process more enjoyable and

As early as nursery school, my report cards (despite “exceeding expectations”) would always mention, “Meghan needs to keep her social interactions to a minimum.” Later,

In the “old days” an awesome client experience meant a friendly front desk person to greet clients, a clean, professional office and knowledgeable caring staff

A sizable chunk of private companies still aren’t ready to implement the new lease accounting standard before the end of the year, despite postponements in

Auditors are taking advantage of the remote auditing capabilities they used during the pandemic to do more types of audits and expand priorities like fraud

RSM US announced that the fourth class of its Industry Eminence Program has begun. Launched in 2018 by RSM US chief economist Joe Brusuelas and

There are many ways to grow your accounting business, but one of the most tried and true ways remains through referrals. Referrals are generally warm

Even as the due date for American tax filing and reporting recedes into the rearview mirror, there are still several open items and areas of

QuickBooks Error 3008 is an error QB users often face while opening the QuickBooks desktop application on computers with Windows operating system installed. This error

Shujinko, which makes automated enterprise compliance solutions, has made its SOC 2 audit preparation and readiness portion of its AuditX software available for free. The

For those of you who’re just joining in, part one mentioned my responses to a query from Abigail, a self-employed consultant who uses part of

Focused on NOLs and the differing complexity by state, Bloomberg Tax & Accounting tax experts regularly update corporate state income tax rules and regulations across

The U,S, Small Business Administration is urging food and beverage establishments to submit their applications for the Restaurant Revitalization Fund by next Monday. The deadline

In one of the latest examples (Gallegos, TC Memo 2021-25, 3/2/21) a taxpayer tried to deduct expenses related to team horse roping contests to offset income

It’s my pleasure to field the following question from a reader who reached out to AccountingWeb for information about starting a limited liability company (LLC)

BlackLine, which makes accounting automation software for the monthly close, has released a new solution, BlackLine AR Intelligence. Powered by artificial intelligence, the new accounts

In the first article in this series, I postulated that there is no such thing as a bad client. There might be “bad fit” clients,

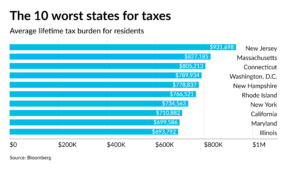

Residents of New Jersey, Massachusetts and Connecticut will face the highest tax burdens over a lifetime, according to a new study. Those living in New

If and when a crisis hits, what do bookkeepers and accountants need to grab so that business/work can continue uninterrupted once we are in a

© Scott M. Aber, CPA, PC