What Are Non-Fungible Tokens (NFTs)?

Imagine I asked you to buy a digital copy of a painting I created and then burned. Perhaps you would be interested in my singing

The latest information from our Accountants

Imagine I asked you to buy a digital copy of a painting I created and then burned. Perhaps you would be interested in my singing

As businesses ramp back up, they need to hire in a tight labor market. Luckily, the Work Opportunity Tax Credit (WOTC) may help for select

Just joining us? We invite you to go back to part one. It focused on the tax rules for profits from sales of personal residences.

Democratic senators rejected any attempt by Republicans to set conditions for increasing the federal debt limit, showcasing an escalation in partisan bickering as a two-year

What could you accomplish if you had an additional 1 percent of revenue in your firm’s IT budget? The answers will be unique to each

The Wall Street Journal reported on July 1, 2021, that the International Accounting Standards Board, the accounting body that sets the financial reporting rules of

OnPoint Audit from CPA.com and CaseWare was built to provide an efficient workflow that reduces manual data entry and redundancies and permits transparent collaboration between colleagues

The Governmental Accounting Standards Board proposed guidance Monday on various accounting and financial reporting issues that were identified during implementation, application and due process on

Many clients working 9-5 jobs dream of owning their own businesses. As their accountant, you realize their idealized view is not the reality. Regardless, many

Take a deep dive into payroll, bookkeeping, and much more. Free Book Preview Money-Smart Solopreneur This book gives you the essential guide for easy-to-follow tips

Proper, a San Francisco-based provider of automated accounting and bookkeeping services for real estate property and asset managers, has scored $9 million in Series A

The Institute of Management Accountants officially appointed J. Stephen McNally as chair of the IMA’s global board of directors, and he plans to focus on

The traditional way of doing IT and SOC 2 audits is going away, and it’s happening really fast, but that doesn’t mean CPA firms can’t

The Internal Revenue Service’s Office of Chief Counsel posted a memorandum on cost-sharing agreements with reverse clawback provisions and their implications for transfer pricing arrangements

Most businesses choose QuickBooks as their primary accounting solution because of its helpful features and timely updates. It has made a name for itself in

Rage against the Machine; property casualty; herbal remedy; and other highlights of recent tax cases. Kissimmee, Florida: Tax preparer Joseph Amaya has been sentenced to

The AICPA’s Professional Ethics Executive Committee (PEEC) and Auditing Standards Board (ASB) have two different goals in their proposals on noncompliance with laws and regulations

The articles that I’ve previously done for AccountingWEB all focus on various aspects of federal income taxes. This one doesn’t; it focuses on New York

Ivix, a technology company that aims to help international tax authorities catch large-scale tax evasion, has scored $13 million in seed funding. The company develops

The Biden administration’s proposals reflected in the “Green Book” include significant revisions in the self-employment tax rules. Here’s what you need to know about what

As CPAs accept that artificial intelligence (AI) is no longer a thing of science fiction, they also must become mindful of the impact it will

Service with a smell; disclosure expectations; new to us; and other highlights from our favorite tax bloggers. Big days The Tax Professional (http://thetaxprofessional.blogspot.com/): The blogger

There are many reasons why accountants and bookkeepers undercharge for our services. And, no, it’s not always because we’re “afraid” to charge what we’re worth.

Nearly one out of five accountants who identified as LGBTQIA left the accounting profession because of a lack of diversity, equitable treatment or inclusion, according

There are currently at least three ways your clients can write off costs associated with boats this year, assuming they itemized deductions. 1. Mortgage Interest

The Internal Revenue Service posted new rules Friday for multiemployer qualified retirement plans that have run into funding problems and need extra financial help from

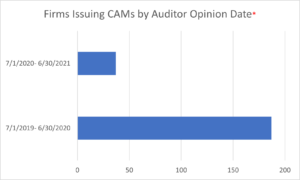

When the PCAOB released Auditing Standard 3101: The Auditor’s Report on an Audit of Financial Statements When the Auditor Expresses an Unqualified Opinion in 2017,

For sci-fi fans, predictions of a tech takeover might trigger thoughts of rebellious robot uprisings the likes of I, Robot or Westworld. Thankfully, we’re not there yet

QuickBooks facility for payroll enables its users to efficiently pay their employees, track their working days or hours, keep records of remittances, and much more.

Most firms understand the need to offer advisory services but struggle with getting their staff to believe they have the skills to be confident advisors.

© Scott M. Aber, CPA, PC