U.S. households paying no income tax hit 61% of total last year

Nearly 61% of U.S households paid no federal income taxes during pandemic-stricken year of 2020, because of declines in income and boosts to government subsidies

The latest information from our Accountants

Nearly 61% of U.S households paid no federal income taxes during pandemic-stricken year of 2020, because of declines in income and boosts to government subsidies

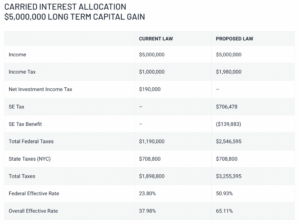

If President Joe Biden’s revenue proposals (the “green book”) for fiscal year 2022 are passed by Congress, fund managers could be facing increased tax liability.

Fintechs were almost five times more likely than traditional lenders to be involved with suspicious loans issued through the U.S. government’s Paycheck Protection Program, according

FreshBooks is a cloud-based accounting software that has made accounting solutions for small businesses relatively simple. With all its features and functionality FreshBooks has become

Often, you start your career as a generalist. But to grow, you have to find your niche—the unique corner of the world where you can

How are we going to get our pricing right in this new world? Accountants work crazy hours and bend over backward to help clients, but

As policy makers struggle to control an affordable housing crunch, officials in some of the world’s biggest cities have their sights set on a tactic:

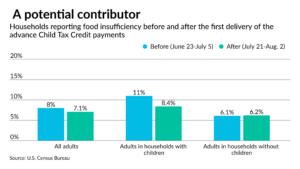

Even as the Internal Revenue Service began sending out the second batch of advance Child Tax Credit payments, evidence has emerged that the first round

Former CEO and chairman of the board of directors of SAExploration Holdings Inc. Jeffrey Hastings pleaded guilty Friday for his role in a scheme to

QuickBooks Accounting Application is a software used worldwide for its user-friendly features and seamless functionality. It works for small-scale businesses enabling them to create customer

The child tax credit is unlike other tax benefits and practitioners should educate their clients now to avoid any unpleasant April 15 surprises. The enhanced

If you are a QuickBooks Online (QBO) user, you know that a foundational feature of QBO is connecting your financial institutions to QBO using bank

Sage, which makes accounting and ERP software, recently debuted a new version of Sage ID and rolled over all Sage ID accounts to the new

Have your business clients recently discovered they’re liable for communications tax? If so, they’re far from alone. Now, the question is: How will you stay

Economic nexus laws are leaping across borders, real money is pouring into the virtual world, and sales tax holidays are causing consternation. Read about all

Normal plans for this time of year might have been thrown by a (second) tax season like no other, but the priorities before fall still

Part one answered unusual questions submitted by Waldo Lydecker, a contentious freelancer, who says he’ll pocket a seven-figure advance in 2021 that’s noticeably north of

How to import data from FreshBooks to QuickBooks is a common search query entered by many accounting professionals. QuickBooks can cover a wide array of

Figuring out nanny taxes and payroll for your clients with household help can be a hassle, not to mention time consuming. But you need to

Expectations and ways of working with clients have changed thanks to the pandemic. There are so many digital platforms that are being used to engage

Xero has unveiled comprehensive improvements to its bank reconciliation feature, the largest upgrade to the function in a decade. In the past 12 months, Xero

As accounting and tax professionals, you may (or might in the future) have clients who have wondered if they should choose a different home state

There are many ways to automate your accounting department, and robotic-process automation can play a key role. Free Preview: Start Your Own Business Submit your

In the past few weeks I conducted two joint retreats, one for sole practitioners and another for two- and three-partner firms. Accountants from 10 states

Quicken helps its users to carry out the major accounting tasks with great ease and efficiency. The users also trust the software to carry important

The booming market for nonfungible tokens is showing no signs of slowing down as investors pour money into digital collectibles, but the tax rules surrounding

The Financial Accounting Standards Board has endorsed a recommendation from its Private Company Council to allow a practical expedient for a private company to determine

Let’s face it: We are done about talking about the pandemic. We’re exhausted. The last 16 months or so have turned our entire worlds upside

Despite today’s digital-first world, for many accountants, document processing and management remains as challenging and archaic as not having a work email for daily communication.

Senate Majority Leader Chuck Schumer moved to wrap up a days-long debate on a $550 billion infrastructure package, setting up the Senate for a Saturday

© Scott M. Aber, CPA, PC