Helping your clients track missing CTC checks

Are you receiving frequent calls from panic-stricken clients this month? If you are, most likely they’re asking the same two questions: Why didn’t I get

The latest information from our Accountants

Are you receiving frequent calls from panic-stricken clients this month? If you are, most likely they’re asking the same two questions: Why didn’t I get

Here’s a nightmare scenario: Suppose a client had wealthy older parents. They had enough cash flow to live a comfortable life and made investments along

There can be a hundred reasons why people stay or leave a firm, but I’ve narrowed it down to four critical issues. Actually I narrowed

Get your accounting education online, fast. Grow Your Business, Not Your Inbox Stay informed and join our daily newsletter now! August 28, 2021 2 min

QuickBooks is an accounting and bookkeeping software that comes along with the feature of creating and maintaining your recurring invoices. A Recurring Invoice is an

The California Society of CPAs announced that Denise LeDuc Froemming will be its next president and CEO, starting Oct. 18, 2021. Froemming will take over

“Touch it once” is a key principle in efficiency. It boils down to the idea of essentially handling things as they come across your desk.

New York-based firm Marcum has released a new data analytics product for audits through Marcum Technology, the firm’s technology arm. Intelligent Prism is an automated

Top 20 Firm CohnReznick has pledged $100,000 to the American Cancer Society to fund multiyear research examining the effects of housing discrimination on cancer cases.

COVID-19 shook the global marketplace. Overnight, businesses large and small had to find their footing in a radically adjusted world — with no clear roadmap

In an ideal world, once your firm selects a niche, your target clients would pop up and come to you. But in reality, you need

Your freelance writer clients will always have write-off questions for you. As such, here are some pointed answers in the final article in this series

Informed business decisions require accurate financial information and solid internal controls. Whether dealing with an internal audit function, the board of directors, an external audit

Investing in real estate is a great way to build wealth, and it’s a strategy that is increasingly used by businesses, rather than individuals. Because

A funny thing happened to accountants when the U.S. Small Business Administration launched the Paycheck Protection Program. There, amid the chaos of the early days

A U.S. District Court judge found that federal prosecutors had withheld financial data from Mr. Avenatti, the former lawyer for the pornographic film actress Stormy

MYOB is a business tool that lets its users create and manage payroll, accounting, POS, and tax operations. Users often confront technical bugs when operating

Accounting Today recently reported on the trend of private equity investments in the public accounting profession. How does this work in light of the fact

The Tax Court recently upheld the IRS’s rejection of an attorney’s “offer in compromise” (OIC) as it was seen as an unreasonably low offer. For a quick

Whether digital goods are subject to sales tax sometimes depends on who you ask. Regardless, states need to sort out sales tax policies on digital products

I wrote a column earlier this month about the critical issues involved in running a small accounting firm. My column identified four critical issues based

The Internal Revenue Service added a new feature Friday to its online portal for the Child Tax Credit allowing parents to update the mailing address

QuickBooks rolls out a software upgrade every year, and it is always exciting to see the new feet of advancements it brings along. QuickBooks is

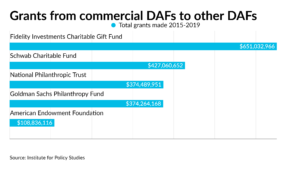

At least $1 billion in commercial donor-advised fund grants went to other commercial DAF sponsors in 2019, according to a new report, rather than being

Tax increment financing (TIF) is a seemingly simple economic development tool that has become anything but—and it’s somewhat controversial in its use to promote improvements in

Financial and occupational fraud has become a serious problem in the United States, clarifying the need for enhanced fraud risk management. Donald R. Cressey’s Other

Get 30 hours of training on how to get your bookkeeping in order. Grow Your Business, Not Your Inbox Stay informed and join our daily

My father-in-law is a very successful attorney. One of his great sayings is: “I’m always looking at the clock, and they are looking at the

In our continuing effort to improve the AICPA Peer Review Program, we rarely take a step back to look at how far we have come

Our focus for this article is on the Section 199A deduction that arose with the 2017 Tax Cuts and Jobs Act and the potential impact new legislation may have.

© Scott M. Aber, CPA, PC