Techniques to Fix Incorrect COGS in QuickBooks Desktop

Incorrect COGS in QuickBooks can cause considerable problems in accounting statements and results. Users must fix this issue quickly to ensure the process and tax

The latest information from our Accountants

Incorrect COGS in QuickBooks can cause considerable problems in accounting statements and results. Users must fix this issue quickly to ensure the process and tax

The problems that triggered SVB Financial Group Inc.’s death spiral were hiding in plain sight in the firm’s earnings reports. That’s according to short seller

Machine learning algorithms are nothing new to QuickBooks, which has been leveraging them more and more over the last few years as part of its

Ernst & Young is pausing its plans to spin off the consulting side of the global network as a separate publicly traded company as it

QuickBooks profit and loss statement shows a summarized account of the total income and expenses of the business at a particular time. With this report,

Over-dependency; from one cell to another; the wrong kind of thinking green; and other highlights of recent tax cases. Boise, Idaho: Tax preparer Andres Sanchez,

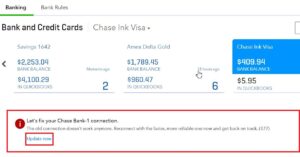

QuickBooks error OL-222 may arise in both Desktop and Online versions and indicate an import failure. Users may face considerable challenges working on QuickBooks when

QuickBooks Error 9999 is a script error in the browser that interrupts QB updates in the application. If you’re troubled by this issue, here’s a

QuickBooks has recently updated its connections with various banks for improving efficiency and reliability of the services. Major Banks like Chase, Bank of America, Wells

The Public Company Accounting Oversight Board issued an advisory Wednesday warning investors to exercise caution when it comes to the so-called “proof of reserve” reports

Organizations are getting ready for the Securities and Exchange Commission to finalize the climate-related disclosure rule it proposed last year, or at least a scaled

Praxity Global Alliance, an association of independent accounting, tax and advisory firms, reported record revenues for 2022 of $8.77 billion Monday, an 11.7% increase over

As part of its diversity, equity and inclusion initiatives, KPMG introduced a Tax Scholarship Program to allow students from underrepresented groups to continue their studies

The Internal Revenue Service is cautioning taxpayers to beware of a new scam involving the Form W-2, in which fraudsters are urging people to use

CohnReznick, a Top 25 Firm based in New York, has expanded in Florida by adding Daszkal Bolton, a Regional Leader headquartered in Boca Raton, effective

QuickBooks Data Migration may become necessary in specific instances for several purposes. However, it is a technical procedure affected by various external interference. Moreover, there’s

Up in Michigan; no touching; gone Pro; and other highlights of recent tax cases. Biloxi, Mississippi: Tax preparer Gena Michelle Hall, 37, has been sentenced

QuickBooks Error 6069 is a versatile error, meaning it can come up anytime while you use the application. A user trying to run QB can

The Institute of Internal Auditors released for public comment Wednesday a draft of the proposed changes it wants to make to its International Professional Practices

QuickBooks error 590 emerges while accessing the banking section in the application. Users can’t sign into their bank accounts and undertake essential operations. Since it

Transforming Free File; what partner agreements omit; excuses, excuses; and other highlights from our favorite tax bloggers. By the numbers Don’t Mess with Taxes (http://dontmesswithtaxes.typepad.com/):

The Internal Revenue Service is giving taxpayers more time to file tax refund claims for tax returns they filed earlier in the pandemic. In Notice

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a

The Internal Revenue Service has extended the tax deadline for disaster area taxpayers in most of California, and parts of Alabama and Georgia as well,

Better phone service from the Internal Revenue Service, overly aggressive third-party-induced Employee Retention Credit claims, a talent shortage, and the sheer amount of updated tax

The Institute of Internal Auditors will soon be unveiling extensive changes in its standards, including a name change. In an email Thursday, the IIA said

At a recent conference on accounting firm growth, several of my co-panelists described the process they used to enter a new market or launch a

Accountants feel confident they are at least keeping pace with increasing technological demands, or are even ahead of the curve. This was one of the

Short answers; corralling crypto; new blog in town; and other highlights from our favorite tax bloggers. Getting phygital TaxMama (http://taxmama.com): Last week, the IRS —

© Scott M. Aber, CPA, PC