Lawmakers demand answers on IRS backlog before next tax season

A group of 99 House Republicans has sent a letter to Internal Revenue Service commissioner Charles Rettig asking for information about how the IRS plans

The latest information from our Accountants

A group of 99 House Republicans has sent a letter to Internal Revenue Service commissioner Charles Rettig asking for information about how the IRS plans

Remember strolling through the aisles of Blockbuster Video to find just the right movie on Friday night? At its peak, Blockbuster owned over 9,000 video-rental

A bipartisan group of Congressional representatives—including Stephanie Murphy (D-FL), Terri Sewell (D-AL), Carol Miller (R-WV), and Kevin Hern (R-OK)—introduced H.R. 6161, the “Employee Retention Tax

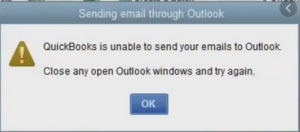

Outlook is a part of Microsoft Office and is used as an email manager. It is not just limited to sending emails; it can also

The Internal Revenue Service is asking more charities and tax-exempt organizations to file their information returns electronically as required by the Taxpayer First Act of

You are required to file 1099 Misc forms to Internal Revenue Service if you are paying $600 or more to a supplier or a dealer

Despite a recent crackdown in the Tax Cuts and Jobs Act (TCJA), the alimony deduction is still “alive and kicking” for many existing divorce or

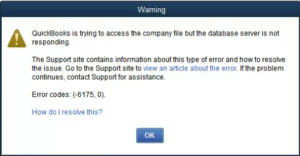

Some specific security applications installed on your computer might cause Error -6094, 0 (6010,2) in QuickBooks. Every time a user tries to start the QuickBooks

Compliance season is fast approaching, and it may have you questioning what new technology you can implement right away to ease some of the frustration from

Details: Crowe, a Top 10 Firm based in Chicago, is adding Briggs & Veselka, a Top 100 Firm in Houston, expanding Crowe’s footprint in Texas,

With the year-end employee reporting season quickly approaching, Greatland has announced the addition of Workday API integration to its popular Yearli tax filing platform. Business

Withum, a Top 25 Firm, has released its annual Year-End Tax Planning Guide, along with a Resource Center with articles and checklists that taxpayers and

Connecting your QuickBooks Software with Bank is a hectic process as you may face various connection errors during the process. Being unable to access your

Disclosure: Our goal is to feature products and services that we think you’ll find interesting and useful. If you purchase them, Entrepreneur may get a

QuickBooks users sometimes come across a strange type of error where the QuickBooks search function suddenly stops working, and users are only left with an

Workplace trends had been moving toward a remote and hybrid workplace for years, but the COVID-19 pandemic accelerated that shift exponentially. The needs of your

The Internal Revenue Service issued guidance on how businesses should handle the retroactive termination of the Employee Retention Credit. The credit was originally meant to

Tax laws have a tendency to change how we, as accountants, do business. Recent rises in inflation have led the IRS to raise the federal

This error occurs when users update their bank feeds in the QuickBooks Desktop application. The error message “QuickBooks was not able to complete your request

For applications such as QuickBooks, downloading the recent updates is a must, as it keeps the program in line with the latest technology and also

Accountants are coming to the aid of doctors and health care organizations who are dealing with not only the COVID-19 pandemic and its variants, but

The Internal Revenue Service said Friday it will be rolling out the ability to electronically file the new Schedules K-2 and K-3 next year, but

Employment increased by 210,000 in November, and the unemployment rate declined by 0.4 percentage point to 4.2%, the U.S. Bureau of Labor Statistics reported Friday,

I have provided tax planning to clients for the past 15 years. There are many ways to do tax planning; however, finding ways to put

For CPAs, perhaps the biggest learning from the pandemic is that collaboration – both with other CPA firms as well as other professions – is

Congress is headed in the right direction. Delaying Section 174 research and development amortization until 2025, as provided in the Build Back Better Act approved

Pharma fraud; foreign affairs; spreading the scheme around; and other highlights of recent tax cases. Union City, New Jersey: Former pharmacy co-owner Igor Fleyshmakher, of

QuickBooks Desktop application encounters several types of errors while performing operations on Windows and Mac operating systems. One of the most common actions that users

No doubt, QuickBooks is the leading accounting software as it manages all the financial information of a user and helps them create invoices, balance sheets,

While many businesses treat employees as disposable, the most effective accounting firms recognize that employees are the firm’s most valuable asset. Accountants tend to be

© Scott M. Aber, CPA, PC