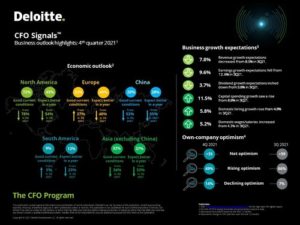

CFOs plan to pay a lot more for workers in 2022

CFOs at major companies are expecting to pay far more money for talent next year, according to a recent survey from Deloitte. The firm’s fourth-quarter

The latest information from our Accountants

CFOs at major companies are expecting to pay far more money for talent next year, according to a recent survey from Deloitte. The firm’s fourth-quarter

The Internal Revenue Service has been stepping up its efforts to provide tax information and resources to taxpayers with limited English proficiency and visual impairments,

Sensiba San Filippo LLP, a Regional Leader based in Pleasanton, California, is adding SGA CPAs & Consultants LLP, a firm based in Bend, Oregon, effective

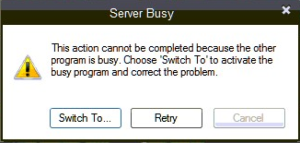

If you are getting QuickBooks server busy error, you are most likely working in a multi-user environment where your company file is stored on the

The Internal Revenue Service has been expanding its telework programs during the pandemic while also trying to fend off cyberattacks. A recent report from the

Error 6010, 100 indicates that an error has occurred while QuickBooks installation and there is a need to reinstall the application. There might be several

QuickBooks is the fastest growing application that specializes in providing accounting and bookkeeping facilities to its users. Simultaneously, the population for its error-affected users is

QuickBooks is a robust application designed to serve various business needs, including payroll processing. Errors are quite common while using the app, and most of

Are you running into an error that displays an error message, “An internal file in QuickBooks has become unreadable [PS107]” while downloading and installing QuickBooks

Mortgaged to the hilt; pocketing the difference; prison schmison; and other highlights of recent tax cases. Pemberton, New Jersey: Mortgage underwriter John Barry Jr. has

Financial and ERG reporting platform developer Workiva has acquired AuditNet, a global provider of audit content and services. Terms of the deal were not disclosed.

The Financial Accounting Standards Board has added two new chapter to its Conceptual Framework. Issued as “concept statements,” the chapters cover the elements of financial

Grant Thornton elects new members of its partnership board; Virginia names its Women to Watch; a large number of firms get named to AM Best’s

In times of crisis, leaders are gifted with the opportunity to lean into new ways of thinking about their business. Amidst the financial crisis, the

After the maintenance release, 5 (R5) for QuickBooks 2021, payroll users using Direct Deposit to pay their employees are required to update their account information

While many firms understand the need for automation, they’ve yet to implement the required solutions and don’t always know where to start. This delay can

If you’re just joining us, parts one and two of this series discussed Internal Revenue Code Section 6672. The law allows the IRS to assess penalties

To help you efficiently manage expenses QuickBooks allows you to import and add invoices from an Excel worksheet or a text file directly into the

Victims of Hurricane Ida in six states now have until Feb. 15 to file various individual and business federal returns and make tax payments. The

Time is quickly running out for accountants to troubleshoot software issues or integrate new accounting technology before tax season really kicks in. Despite the benefits

QuickBooks Payroll is one of the best tools businesses prefer to pay their employees quickly and reliably and plays a vital role in employee payroll

As we prepare for 2022, bookkeepers have a unique opportunity to set (or reset) their expectations and vision. In fact, now is the right moment to

Accountants and other finance professionals who want to better serve low-income and underserved communities can start by understanding the access barriers these groups face in

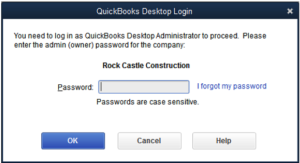

At times, you might need to reset or remove the password from the QuickBooks company file. Due to the increasing number of cyber security threats,

The Public Company Accounting Oversight Board released updates to its staff guidance on Form AP, which auditors use to disclose the engagement partners and auditing

What would cause a tax professional to need to review R&D tax benefits for midsized or smaller clients? The main tax savings can arise from the

Most QuickBooks users face issues while doing online banking in QuickBooks that arise because of the faults made by users while setting up banking and

Due to the COVID-19 pandemic and other extenuating circumstances, more people than ever are freelancing. Whether you are part of the “gig” economy (Uber, Airbnb,

The IRS announced (IR-2021-251, 12/17/21) that standard mileage rates are on the rise for the 2022 tax year. The increases are bigger than they’ve been

Victims of this month’s weather in Illinois and Tennessee have until May 16 to file various federal individual and business returns and make tax payments.

© Scott M. Aber, CPA, PC