Lack of understanding and tax issues hold back crypto investment

Cryptocurrencies are gaining in popularity, but for those who have chosen not to invest, a lack of understanding of the asset itself was cited as

The latest information from our Accountants

Cryptocurrencies are gaining in popularity, but for those who have chosen not to invest, a lack of understanding of the asset itself was cited as

Accountants need to remind clients that their day of reckoning with the IRS is happening in just a few weeks. This is the first article in

The Supreme Court of Texas reversed the Texas Court of Appeals decision in a closely watched franchise tax case regarding apportionment of service receipts. In

We recenly spoke to Sage’s Ed Kless to talk about outcomes vs. outputs, why he joined the agenda at AccountingWEB Live Summit, and what you

The accounting and medical professions are similar in that practitioners in both need a good “bedside manner.” They need to gain the trust and support

The International Public Sector Accounting Standards Board released for public comment an exposure draft of a proposed standard for multi-employer retirement plan obligations. The goal

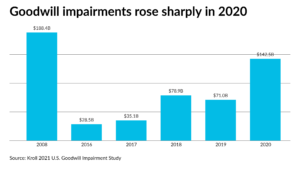

The total value of goodwill impairments recorded by U.S. public companies more than doubled in 2020 during the first year of the COVID-19 pandemic, according

The Governmental Accounting Standards Board set the effective date for the GASB 87 leases standard at June 15, 2021, after pushing it back by 18

Garret Layman BKD CPAs & Advisors, Springfield, was named one of the top organizations in the country for internal learning and development by Training magazine.

Colorado is to become the latest state to accept crypticurrency for tax payments now, taking up the mantle. During a February 2022 interview, Governor Jared

Susan Coffey, CPA, CGMA, has worked for the Association of International Certified Professional Accountants (the Association) for more than 30 years, but she never gets

In addition to the fantastic networking opportunities and engaging content agenda you’ll find at the AccountingWEB Live Summit this May in San Diego, we also have exhibit

In addition to the fantastic networking opportunities and engaging content agenda you’ll find at the AccountingWEB Live Summit this May in San Diego, we also have exhibit

The International Sustainability Standards Board unveiled two proposed standards Thursday for general sustainability-related disclosure requirements and specific climate-related disclosure requirements as the new board tries

AccountingWEB recently had the pleasure of chatting with Dawn Brolin, CPA, CFE and owner of Powerful Accounting, about the growing importance of firms having the

Hackers breached a video game-linked blockchain network called Ronin and stole about $600 million worth of cryptocurrency, one of the largest such heists to date.

Many neighborhood accountants have clients who own well-established, local businesses, like the dry cleaners or a popular veterinary practice. They might plan to continue working

Employment growth at small businesses moderated slightly in March, but wages continued to increase, according to payroll giant Paychex. The Paychex | IHS Markit Small

When preparers or younger accountants complete their assignment, but before they submit it for review, I suggest they review it for reasonableness. I offered a

The Internal Revenue Service updated its frequently asked questions page Friday on how tax professionals should deal with the third round of Economic Impact Payments

Over three-quarters of the audits conducted by the Internal Revenue Service under its centralized partnership audit regime resulted in no change in taxes, according to

Rachel Fisch never thought she would work for another accounting firm after she landed a job at Sage, but that changed when High Rock Accounting

Devising our first-ever live event specifically for accountants that had a mix of the expected and unexpected was no small task, but it’s a challenge

Opinions expressed by Entrepreneur contributors are their own. When you are in the beginning stages of starting a business, it is often challenging to balance

Of the 175 million advance Recovery Rebate Credits issued by the Internal Revenue Service in 2021, more than 1.2 million payments worth $1.9 billion may

The way we work has changed forever. Today, employees consider work-life balance, the option to work remotely and a strong cultural fit when looking for

Although there’s comparatively less sales tax fraud in this country, there are plenty of fraudulent sales — and some lawmakers think it’s time marketplace facilitators

CPAs are problem-solvers at heart. They take on difficult projects with pride and give their all for their clients. While these are great attributes, it

This two-part series will be devoted to the twists and turns in the rules that govern sales of investments to “related parties” (Internal Revenue Code

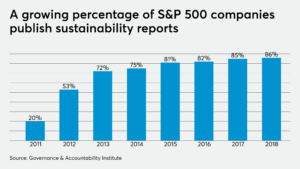

KPMG International has announced updates on its progress for a wide range of ESG commitments. Launched in 2021, “KPMG: Our Impact Plan” merges all of

© Scott M. Aber, CPA, PC