IRS tweaks crypto guidance for Bitcoin

The Internal Revenue Service has slightly revised its 2014 guidance on the treatment of virtual currency to reflect the fact that some countries now accept

The latest information from our Accountants

The Internal Revenue Service has slightly revised its 2014 guidance on the treatment of virtual currency to reflect the fact that some countries now accept

Matt – stock.adobe.com If you or a client of yours is planning on selling a company, here are 24 documents you’re going to have to

Republican leaders in the House proposed legislation this week to strip the Internal Revenue Service of much of the $80 billion in extra funding it

Oklahoma enacted changes in the number of hours needed for CPA candidates to sit for the CPA exam, reducing them from 150 credit hours to

To move QuickBooks to another computer is a great deal, especially when you have loads of crucial data on your storage. You may have to

The American Institute of CPAs is asking the Internal Revenue Service to offer more guidance on how to help taxpayers compute their losses on digital

The Senate Budget Committee opened an investigation after Credit Suisse fired a lawyer it had hired to oversee an independent inquiry hunting for accounts linked

The Internal Revenue Service is still studying the feasibility of offering its own free online tax preparation system, and its new leader is not ready

Victims of storms in Indiana now have until July 31 to file various federal individual and business tax returns and make tax payments. The IRS is offering

As the economy stays on shaky ground, middle-market organizations are increasingly opening up the company purse and making smart investments in technologies to become more

QuickBooks refresher tool is as excellent as its name. It will refresh your application entirely and let it run error-free. You can say goodbye to

If you have got QuickBooks error 12007 in the middle of your QuickBooks update, then there is nothing to worry about, as it is quite

Make it a time of personal inventory, of looking back and taking account.

The Internal Revenue Service wants to hire more accountants, lawyers and other professionals to focus on high-income taxpayers and large corporations that are not paying

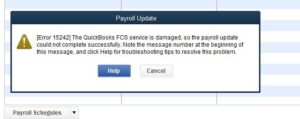

QuickBooks error 15242 is a payroll error that interrupts the ongoing payroll update. If you can’t access software improvements and security patches because of the

The Supreme Court ruled Friday in favor of a Texas accountant who challenged the constitutionality of a Securities and Exchange Commission administrative law judge holding

New York-based EFPR Group lowered its annual hours requirement to 2,080; staff at Traphagen CPAs continued a 50-year tradition of shaving their tax season beards

An Audi, a Porsche and a sentence; Stop and gone; bad Company; and other highlights of recent tax cases. Surprise, Arizona: Anthony Henry Williams, 52,

QuickBooks error 1903 affects the users trying to install QuickBooks Desktop on their devices. You know how troublesome it can get if you suffer from

The CIO’s leadership role continues to elevate in high-performing firms. Many CIOs now have a dual role of chief digital and innovation officer, while some

QuickBooks Tool Hub is one of the best utilities Intuit could develop to eliminate the various QuickBooks errors. If you are looking to find more

Ernst & Young’s top leaders called off a planned breakup of the firm’s consulting and audit practices after the U.S. affiliate decided not to take

Do you want to learn how to print pay stubs in QuickBooks Desktop and Online? Keep reading this blog and find comprehensive details about the

The Internal Revenue Service and the Treasury Department issued a notice Monday offering a safe harbor for the deed language in charitable conservation easements. The

Are you wondering how to send paystubs in QuickBooks? The process has never been more straightforward, and we ensure you can execute it seamlessly with

A Volkswagen AG GTE Golf hybrid automobile at a charging stationLuke MacGregor/Bloomberg Volkswagen AG believes that electric-vehicle incentives put in place by President Joe Biden’s Inflation Reduction

This year’s IRS Dirty Dozen offers scams both familiar and new. ID theft is a frequent motivation. Crooked tech and equally crooked tax preparers make

Tax leaders at companies around the world are predicting the number of tax audits will increase by more than a third over the next two

New York Republicans, whose congressional ranks swelled in the last election, are reviving plans to expand the state and local tax break, picking up a

The American Institute of CPAs sent a list of recommendations to the Treasury Department and the Internal Revenue Service asking them to clarify and expand

© Scott M. Aber, CPA, PC