Tax Court Approves Vehicle Deductions for Side Gig

The recent Tax Court case Gonzalez, TC Summary Opinion 2022-13, 7/18/22 found that it is indeed OK to deduct vehicle expenses related to a side-gig, as long

The latest information from our Accountants

The recent Tax Court case Gonzalez, TC Summary Opinion 2022-13, 7/18/22 found that it is indeed OK to deduct vehicle expenses related to a side-gig, as long

The Internal Revenue Service has released a draft version of the Form 1040 for next tax season, with an expanded question about virtual currencies, now

While there are many ways to look at capacity, most firm leaders agree they don’t have enough people to properly serve the number of clients

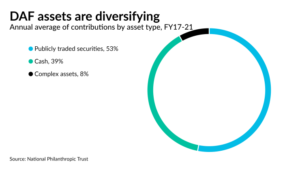

Donor-advised funds have been receiving more than half of their contributions from complex assets such as shares of public and private companies, real estate and

Private equity firm Vista Equity Partners today agreed to acquire global tax compliance player Avalara in an all-cash deal worth $8.4B. The Seattle-based cloud tax

We’re in the middle of 2022. Have you made the changes necessary to go from a good partner to a great partner? The year is

The Senate passed a landmark tax, climate and health-care bill, speeding a slimmed-down version of President Joe Biden’s domestic agenda on a path to becoming

All Bonadio Group offices were closed on Friday, as the CPA firm celebrated its fifth annual Purpose Day. This tradition encourages staff members to spend

The American Institute of CPAs has sent comments to lawmakers in the House and Senate about the tax proposals in the Biden administration’s climate, tax

I recently wrote an article about how to implement conference lessons for lasting change. If you haven’t read that I would encourage you to do

The self-employed often come to CPAs for business advice, so why not retirement planning? As the number of entrepreneurs grows, CPA firms can grow with them

Opinions expressed by Entrepreneur contributors are their own. Bookkeeping is the foundation for all small business insight. If you’re running a small business, you’ve got

One sentence at a time; comp con; D.A. cleared; and other highlights of recent tax cases. New Orleans: Two tax preparers have been sentenced for

The Financial Accounting Standards Board, a private organization run by a seven-member board, determines how quarterly and annual profits are calculated.

I firmly believe that if it were not for my firm’s ability to think outside the box and pivot – expanding our offerings from our

A climate and tax bill could give a lot of power to an organization called the Financial Accounting Standards Board.

The Institute of Management Accountants is seeing signs of a lax attitude toward ethics developing in recent years as more people work from home and

Most business leaders are aware of the current state of the market. High inflation, trade barriers, geopolitical risks, and labor shortages have pinned executives’ attention

If you’re a CPA and your property-owning clients are asking you how they should prepare for a cost segregation study, this article will guide you and

The IRS is continuing to hone its filters to catch business identity theft and tax fraud, using 84 selection filters last year to identify business

To help prepare your firm for the great migration, here are the major pitfalls of migrating to cloud computing and suggestions as to when you

The California Society of CPAs named Tayiika Dennis, a principal at Top 100 Firm CliftonLarsonAllen in Los Angeles, as the new chair of the CalCPA

Two of 11 defendants charged with running a $300 million cryptocurrency-based Ponzi scheme have agreed to settle with the Securities and Exchange Commission. The case

The pandemic shifted the way accounting firms seek out employees. Before it started, we had ten fully remote employees. These staff members had started their

With the economy posting two consecutive quarters of declining gross domestic product numbers, recession worries have deepened, and firms are counseling their clients about how

July is Disability Pride Month, commemorating the landmark Americans with Disabilities Act of 1990. In the 32 years that have followed, we have seen the

You may not think of it this way, but you spend a lot of time evaluating the value of items and services. Whether you shop

The American Institute of CPAs, New York, named the recipients of its 2022 Effective Learning Strategies Awards: Kimberly Young of Greenville Technical College in South

Business is all about relationships. When you work with clients, you get to know them on a business and a personal level. You might ask

The American Institute of CPAs named the recipients of the 2022 Effective Learning Strategies Awards to college and university educators, and also honored four other

© Scott M. Aber, CPA, PC