Significant Tax Effective Dates Through 2025

Our goal in this article is to help the tax professional’s planning by noting significant tax provision effective dates over the next few years. First,

The latest information from our Accountants

Our goal in this article is to help the tax professional’s planning by noting significant tax provision effective dates over the next few years. First,

While neither Sage nor Lockstep disclosed the terms of the purchase, which is anticipated to be completed in September, it is unlikely to have come

Deloitte’s Center for Controllership released a new poll highlighting why accounting firms are looking for new talent, and why accountants are leaving their posts. The

New York State is expanding a tax break that allows smaller companies to circumvent the $10,000 limit on state and local tax deductions from the

Many CPAs don’t realize how everyday tasks can easily expose them to malpractice litigation. The causes of litigation are well known, and so too are the

The Public Company Accounting Oversight Board reported Friday it uncovered a high rate of deficiencies last year in firms that perform audits of broker-dealers similar

AuditClub™, the Audit Service Center for CPAs, has launched of its new auditors-as-a-service model, designed to provide top 10, regional and local CPA firms with

Rep. Bill Pascrell, D-New Jersey, sent a letter to Internal Revenue Service Commissioner Charles Rettig requesting details on how the agency will use the funding

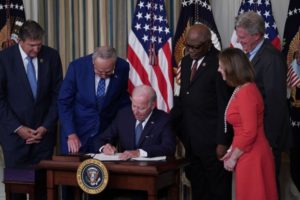

The Inflation Reduction Act that President Biden signed into law this week has a lesser known provision that could benefit many small business startups, allowing

Lack of clarity about when to screen for the Work Opportunity Tax Credit (WOTC) factors makes the tax credit less effective. Designed to provide more

As you transition your firm from compliance focused services to client advisory services (CAS), your focus will shift from providing your clients with “deliverables” to

Internal Revenue Service Commissioner Chuck Rettig is promising not to use the nearly $80 billion his agency will be receiving over the next 10 years

We would usually tell our clients that contingent income, income you may well not receive, isn’t taxable. However, that is not necessarily the case under

Market volatility is inevitable. But even though markets have always had their ups and downs, new periods of volatility often lead to uncertainty and anxiety.

A good accountant, preferably with a background in the franchising industry, can help mitigate your financial risk. If you need capital, they can help service

Section 45L of the Internal Revenue Code provides both single and multifamily homebuilders with a $2,000 tax credit for meeting certain energy saving requirements. However,

If a couple files a joint tax return, they are generally both liable for any tax liability, even if only one of the spouses is

The question is not how to make it easy to communicate and exchange information with clients, it already is far too easy for them to

A growing number of CPAs are turning to tools from outside the accounting world like Stream Deck as a way of boosting their efficiency. But how

U.S. lawmakers are pressing the IRS to explain how it plans to relieve a backlog of tax returns that have delayed refunds and to detail

Accounting firms face unprecedented hiring challenges, and while some roles demand a high level of expertise or a CPA license, not all do. So, why

House Democrats delivered the final votes needed to send President Joe Biden a slimmed-down version of his tax, climate and drug price agenda, overcoming a

Big Four accounting firm KPMG LLP nominated Derek Thomas as national partner-in-charge of the firm’s university talent acquisition. Thomas joined the firm in 2000 as

The Trump Organization and its longtime chief financial officer, Allen Weisselberg, will go on trial Oct. 24 on tax fraud charges, after a New York

The Statement on Auditing Standards (SAS) No. 136, Forming an Opinion and Reporting on Financial Statements of Employee Benefit Plans Subject to ERISA, requires auditors

The Inflation Reduction Act that Senate Democrats managed to pass on Sunday and that is heading for an expected vote in the House on Friday

From the smallest to the largest accounting firms, recruiting and retaining talent seems to bring about rough seas. The most recent 2021 PCPS CPA Firm

I probably don’t have to explain the panic that ensues when you realize that you may have “outgrown” your accounting software. The time and effort

Since former President Donald J. Trump declined to answer questions, Attorney General Letitia James faces a crucial decision.

The American Institute of CPAs wants the Internal Revenue Service to pick up the phone faster on its so-called Practitioner Priority Service for tax professionals

© Scott M. Aber, CPA, PC