QuickBooks Payroll Subscription – An Ultimate Guide To Do

QuickBooks payroll subscription allows users from all fields to automate payroll operations and achieve efficiency and effectiveness. In addition, users can access numerous benefits from

The latest information from our Accountants

QuickBooks payroll subscription allows users from all fields to automate payroll operations and achieve efficiency and effectiveness. In addition, users can access numerous benefits from

The Financial Accounting Standards Board has been receiving comments on its proposed accounting standard for crypto assets as it works to impose the first rules

To investigate the practices of a group of political nonprofits, we first needed to conquer a pesky foil of data journalists: the PDF.

Members of the Senate and House introduced bipartisan legislation to expand the Affordable Housing Tax Credit. The Affordable Housing Credit Improvement Act, introduced Friday, would

The Senate Finance Committee examined the impact of the Tax Cuts and Jobs Act on pharmaceutical makers’ taxes and found the law enabled some of

The Internal Revenue Service is taking steps to reduce the likelihood of harm to its employees by removing their first names from correspondence, but their

Pearl jam; that’s a whole lot of shingles; rocking their world; and other highlights of recent tax cases. New York: Amir Bruno Elmaani, of Martinsburg,

Harlan Crow, a Texas billionaire and GOP donor, has refused a request by Senate Finance Committee Chairman Ron Wyden to detail the extent and tax

PricewaterhouseCoopers is investing $1 billion in artificial intelligence technology like ChatGPT while also pouring money into geospatial technology to track rising sea levels and other

The Internal Revenue Service’s Knowledge Management Program for disseminating employee advice and information has been difficult to use, and the employees who are supposed to

Opinions expressed by Entrepreneur contributors are their own. You may have heard this story (or one like it) before: Imagine this: A top sales executive,

This company file needs to be updated, a message many users have come across recently. So let’s look into this blog and understand what this

Deloitte completed its eight annual Audit Innovation Campus Challenge, awarding University of Nebraska-Lincoln students first place for their audit project. The AICC challenge promotes innovative

The Institute of Internal Auditors sent Congress a legislative proposal recommending that all cryptocurrency exchanges operating in the U.S. should possess an independent internal audit

Schulman Lobel LLP, a New York-based accounting firm, acquired the tax compliance division of DFP Partners, and merged with Tanton Grubman CPAs LLP and Steinberg

QuickBooks reconciliation problems may arise while users compare their documents to verify accuracy. If you’re troubled by these issues, we have brought this in-depth guide

No prize in the box; slick; Pacific time; and other highlights of recent tax cases. Vancouver, Washington: Saul Valdez, owner of a business that offered

The company file in use QuickBooks error description can frustrate any user. It can induce panic while users look for ways to rectify the situation.

QuickBooks error 6000 causes bumps when users try opening their company files. The error makes accessing the company file in both local and network setups

A group of senators on both sides of the aisle is asking the Internal Revenue Service’s new commissioner, Daniel Werfel, to warn taxpayers and tax

Dumping bad clients; another crypto challenge; no IRS notice; and other highlights from our favorite tax bloggers. Debt do us part Well-worn paths Tax Pro

QuickBooks Migration Failed Unexpectedly error arises when a user tries to transfer their files from one place to another. It can be one SSD to

BDO USA LLP unveiled its initial sustainability report Monday, highlighting areas where it has made progress in its environmental, social and governance efforts. The report

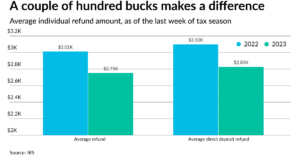

The verdict for this year’s tax season is that it was one of the most normal in years, without any of the craziness of the

Victims of severe storms, straight-line winds and tornadoes in Oklahoma on April 19 and 20 now have until Aug. 31 to file various federal individual and

The narrow requirements for qualifying for the electric vehicle tax credits under the Inflation Reduction Act are causing some consternation in the auto industry, as

Internal Revenue Service commissioner Daniel Werfel defended the IRS’s budget during congressional testimony Thursday, a day after House Republicans passed a bill that would eliminate

Whitley Penn is adding Cogenics Consulting, a technology consulting firm in Pleasanton, California, expanding the Fort Worth, Texas-based Top 50 Firm’s client accounting and advisory

The statute’s start; chat’s all, folks; costs of fraud; and other highlights from our favorite tax bloggers. Just saying Post-game show Wolters Kluwer (https://www.wolterskluwer.com/en/solutions/tax-accounting-us/industry-news): Another

© Scott M. Aber, CPA, PC