RPA on the rise in accounting

Robotic process automation has become a necessary technology for many accounting firms that are trying to achieve more efficiency as the staff becomes harder to find during the ongoing pandemic.

Firms like Deloitte are increasingly relying on RPA technology and showing clients how they can achieve more with an already overburdened staff who are desperately trying to keep up with the workload during the stressful pandemic. “RPA is the here and now kind of technology that organizations are utilizing,” said Brian Cassidy, audit and assurance partner and trustworthy AI leader at Deloitte.

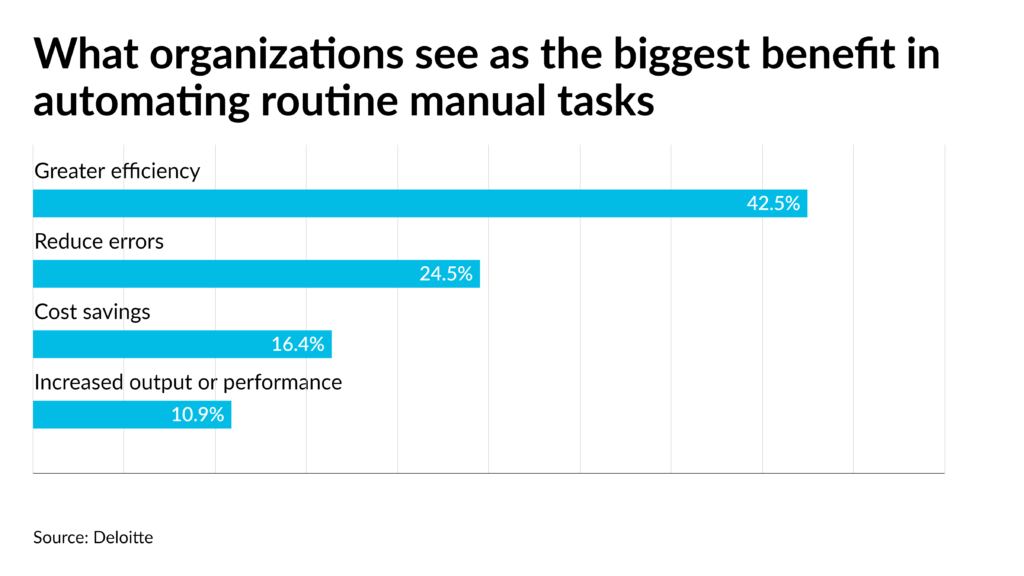

He participated in a panel discussion of technology experts from the firm at Financial Executives International’s Current Financial Reporting Insights conference last month. They asked attendees what they saw as the greatest benefit of automating routine manual tasks in their day-to-day job, and the top choice was greater efficiency (42.5%), followed by reduce errors (24.5%), cost savings (16.4%), and increased output or performance (10.9%).

RPA is being used in conjunction with other technologies such as artificial intelligence, blockchain and digital assets by firms like Deloitte. “In the blockchain and digital assets, in most cases you’re employing technology to drive efficiency, to drive cost savings, to drive better talent resourcing,” said Cassidy. “Those are some of the reasons you’d normally employ technologies. In the digital asset space you’re actually employing a blockchain to get access to a digital asset like cryptocurrency. You think about the lifecycle of emerging technologies, and you start with RPA and go to blockchain and then you get to artificial intelligence, which is probably the most in infancy stage at organizations, but has the highest growth rate.”

AI is increasingly working its way into organizations, as anybody who starts to write an email or text message often finds now as the device tries to complete their thoughts for them. AI is showing up more in accounting as well.

“When we think about that emerging technology trend, as accountants and auditors, we always get told that we’re looking backward at financial reporting statements,” said Cassidy. “The history has already happened. It’s done. As accountants and auditors we are trying to be forward thinking. There are emerging technologies within that maturity cycle of RPA into blockchain and into artificial intelligence. When you think about these technologies, they do build on each other a little bit, but they are different and distinct. RPA, for example, is usually part of artificial intelligence, but where we are headed with artificial intelligence is organizations using artificial intelligence in a human decision-making capacity.”

Firms are also getting more acquainted with digital assets as their clients explore the use of cryptocurrency such as Bitcoin or Ether for payments or investments.

“If you want to be part of investments in digital assets — and pick your digital assets: crypto, Ether, whatever it is — you need to be part of the blockchain,” said Cassidy. “That’s the only way it works. So the desire to have that asset on your books is what’s driving the technology. But you need to recognize that not one size fits all when you’re dealing with crypto. Just look at the regulatory environment. The regulators, like FASB and the SEC are all talking about crypto, but nobody has made a key differentiation or put a line in the sand on anything. Everyone is still taking that data in. It’s understanding those facts and circumstances that might impact your overall organization, and therefore with this emerging technology you probably need to lean on advisors to help you with this because it’s a very challenging and growing topic.”

Firms and their clients need to be aware of the risks of such technologies, however. “Whether you’re talking about RPA, blockchain, digital assets, or AI, emerging technologies do provide many benefits to people in their day-to-day life across the financial reporting supply chain network stakeholders, but they also come with risk,” said Cassidy. “With your roles and responsibilities in the financial reporting structure of an organization, it’s understanding those risks and mitigating those risks that’s truly helped to generate long-term value for organizations. The last thing you want to see is a blip up or a blip down because something went wrong or didn’t go right. What I would say is that these emerging technologies need to have risk and governance around them in organizations and there’s a key role for audit professionals and advisors to identify those risks, put structures in place to help organizations mitigate said risks so that when they are implementing within an organization, it ends up starting to generate long-term value soon.”

Accountants are also these advanced technologies to help clients with the increasing demand for environmental, social and governance reporting. “ESG is a topic that everybody is talking about,” said Cassidy. “Everybody focuses in that ESG conversation on the E, environmental. I think about our profession, as an overall organization, certified public accountant, the goal we’re trying to mitigate is risk to the P, the public. So, we talk about ESG and governance. We talk about controls and governance, and what are we trying to do it for? We’re trying to do it to help the public good in some form or fashion, whether that be in organizations and shareholders or whether it be in how they impact the overall financial reporting landscape, for customers, users, auditors. It’s the general P in public. While maybe in AI, for example. machines and computer systems will take the place of a person doing a certain job, but that person doesn’t disappear. They move on to doing something else. But that doesn’t also mean that governance of that system disappears. We still need to make sure that the computer systems are putting out the correct information. It’s really governance, and why the auditors are involved because of the P in public, because that’s what we do from a profession standpoint.”