PCAOB proposes overhaul of quality control requirements for audit firms

The Public Company Accounting Oversight Board has proposed a set of significant changes in the requirements for auditing firms’ quality control systems, in a major update from the earlier standards in place for decades.

The proposed standard is part of the PCAOB’s efforts to modernize the standards it inherited 20 years ago from the American Institute of CPAs when the auditing regulator was created as part of the Sarbanes-Oxley Act of 2002. It will require audit firms to take a risk-based approach in their quality control systems and include oversight from someone outside the firm.

The changes come as investors have called for the PCAOB to improve its own oversight of the auditing profession after financial scandals have rocked the industry in the U.S. and abroad.

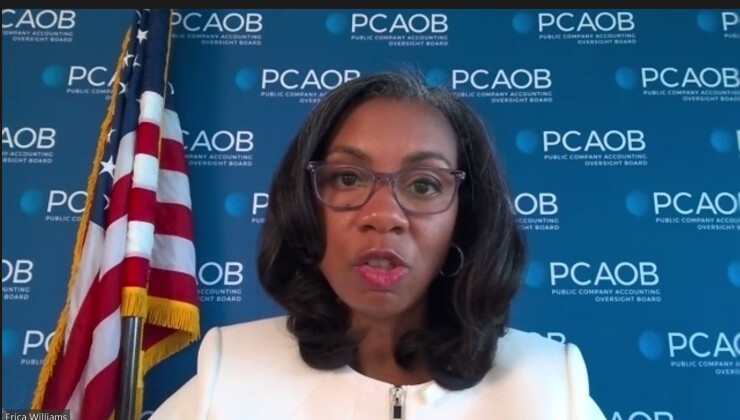

“Today’s proposal is a watershed moment for the PCAOB as we propose to make significant changes to our requirements that address firms’ quality control systems — requirements that largely look the same today as they did 20 years ago when the PCAOB was founded,” said PCAOB chair Erica Williams during a meeting Friday to consider the proposal and approve the PCAOB’s five-year strategic plan and 2023 budget.

She said she supports the proposal. “Firms’ quality control or QC systems lay the foundation for how they approach audits,” she added. “When a firm’s QC system operates effectively, audits are performed in accordance with applicable professional and legal requirements. Simply put: Effective QC systems protect investors, while ineffective QC systems put investors at risk.”

Some of the main aspects of the proposal include requiring the use of a risk-based approach as a firm designs and implements its QC system; and requiring certain firms to establish an oversight function for the audit practice that includes at least one person who is not a partner, shareholder, member, other principal or employee of the firm.

The proposal includes requiring implementation of specific monitoring procedures, such as in-process engagement reviews, to keep an auditing firm’s leadership informed about potential problems and where to dedicate resources to address those issues. The new rules aim to encourage an ongoing “feedback loop” that drives continuous improvement.

Firms would need to do an annual evaluation of their quality control system and report back on the results to the PCAOB as well as audit committees.

Some of the proposed requirements would apply to all firms registered with the PCAOB, including those that don’t currently audit public companies or SEC-registered broker-dealers.

The proposed standard, if adopted, would replace the current quality control standards in their entirety and provide a framework for a firm’s QC system to proactively identify and manage risks to quality, with a feedback loop from ongoing monitoring and remediation designed to drive continuous improvement at firms. The proposal would encourage a more structured approach in which a firm would evaluate its quality control system on an annual basis and report the results of its evaluation on a new Form QC.

Williams is encouraging firms to read through the proposal and provide their perspectives to the PCAOB, and she also wants feedback from investors, investor advocates, preparers, members of audit committees, and academics, along with all other stakeholders.

“Unlike changes made to individual auditing standards that address auditor performance or disclosures, the changes being proposed today affect the entire audit from accepting the engagement, to planning and performing the audit, and finally, to reporting out the results,” said Williams. “By elevating all firms’ QC systems, this proposal directly aligns with our mission to protect investors and further the public interest in the preparation of informative, accurate and independent audit reports.”

The PCAOB has been working on the proposal for several years, but the effort gained new impetus when most of the members of the PCAOB were replaced this past year and charged with updating the older standards inherited from the AICPA. In December 2019, after hearing input from its advisory group, the PCAOB issued a concept release that generated comment letters from firms, investors, investor advocates, academics, trade groups and others. That feedback, along with the PCAOB’s own quantitative and qualitative economic analysis, helped inform the proposal.

The PCAOB is asking for comments by Feb. 1, 2023 on the proposed standard.

In voting to approve the budget and the five-year strategic plan, Williams pointed out that about one year into the current board’s term, the PCAOB has been working to update more than 30 standards within 10 standard-setting projects. During that time, the PCAOB has more than doubled the total dollar amount of penalties imposed against individuals in 2022, compared to the past five years.

“The PCAOB has also quadrupled the average penalty against firms in cases where firms fail to meet PCAOB reporting requirements and increased the average penalties against firms in all other cases by about 50%,” Williams said in a statement after approval of the budget and the strategic plan. “In the past five years, the PCAOB assessed penalties against individuals less than half of the time and firms only about 86% of the time. This year, it’s 100%.”