Over $1B in donor-advised funds went to other DAFs

At least $1 billion in commercial donor-advised fund grants went to other commercial DAF sponsors in 2019, according to a new report, rather than being distributed to charity.

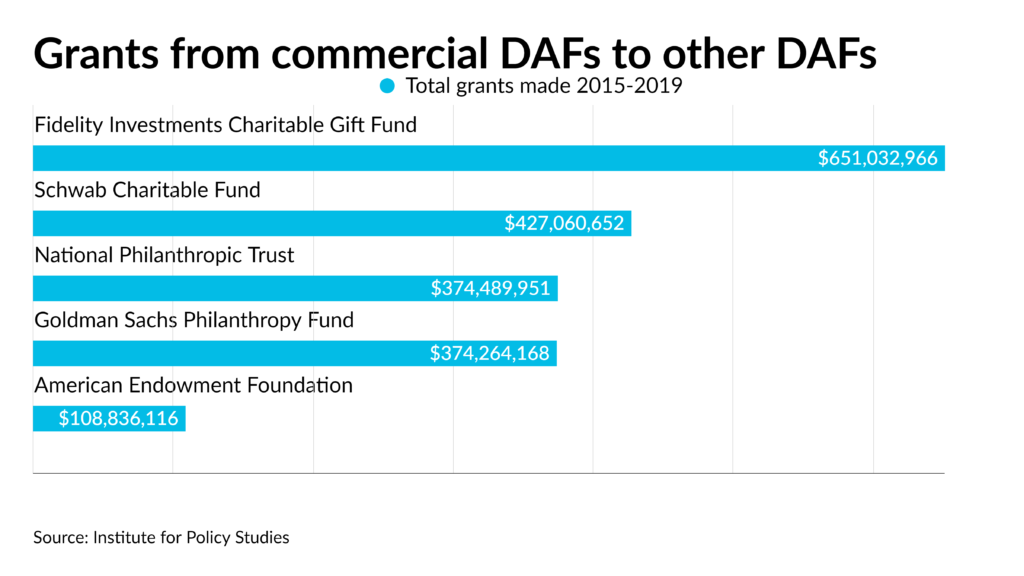

The report, released Thursday by the Institute for Policy Studies, found that over the five years analyzed from 2015 to 2019, the 39 electronically filing commercial DAFs granted a total of $2 billion to other commercial DAFs. The Fidelity Charitable Gift Fund gave out the most in grants to other commercial DAFs, with a total of $651 million granted over those five years. Schwab Charitable, the Goldman Sachs Philanthropy Fund, and the National Philanthropic Trust also contributed significant amounts to commercial DAFs over that time period.

Donor-advised funds have become an increasingly popular way for wealthy Americans to give to charity and receive tax deductions for charitable contributions. The value of DAF grantmaking to qualified charities reached $8.32 billion last year, according to a separate report by the National Philanthropic Trust, a 29.8% increase compared to 2019, in part due to the increased needs created by the COVID-19 pandemic (see story). However, it seems that many of the contributions in recent years have been shifting away from charities and going to other investment vehicles.

“This is the tip of the iceberg in DAF-to-DAF giving,” said Helen Flannery, director of research at the Charity Reform Initiative, in a statement. “We are seeing a growing amount of charitable dollars warehoused in intermediaries such as private foundations and DAFs. DAF sponsors will argue that we should leave them alone, and that they are already giving plenty to charity. But our findings put this lie to this claim. We have to have payout requirements for DAFs, and we have to have greater transparency into their giving so we can find out what their impact really is.”

Holders of donor-advised funds have come under pressure to release more money to aid worthy causes, especially during the pandemic. In June, Sen. Angus King, I-Maine, and Chuck Grassley, R-Iowa, introduced legislation to encourage DAFs to distribute funds more quickly. But even their bill would allow DAFs to hold funds for 15 or 50 years and still receive tax benefits.

The new report found that DAFs are increasingly transferring more money between funds instead of disbursing it to charity. While only $209 million was transferred between commercial DAFs in 2015, the $1 billion transferred between commercial DAFs in 2019 represents growth of 409% over that period, an average effective growth rate of 50% per year. This type of DAF-to-DAF giving grew at more than triple that rate, 166%, from 2018 to 2019.

All 31 of the commercial DAF sponsors in the IPS analysis gave to another commercial DAF in at least one of the five years from 2015 to 2019. On average, 22 commercial DAFs gave to at least one other commercial DAF in any given year. Most DAFs gave to just three or four different commercial DAFs each year. But the largest — including Fidelity Charitable, Schwab Charitable, the National Philanthropic Trust, the American Endowment Foundation, and Morgan Stanley Global Impact Funding Trust — distributed grants to 16 or more other commercial DAFs each year.

The National Philanthropic Trust responded to a request for comment by forwarding a report of its own comparing DAF grant payout rates to private foundations, saying the payout rate for DAFs exceeds that of private foundations by three to six times, depending on the payout formula, and DAFs’ charitable assets equate to only 14% of private foundations’ charitable assets.

“The consistency in the grant payout rate over more than a decade and across DAF sponsor types demonstrates that DAF donors are giving at steady rates regardless of which type of DAF sponsor they choose,” said the NPT report. “This is an important observation that challenges the notion that some sponsor types are ‘warehousing wealth.’”

Fidelity Charitable, Schwab Charitable, Goldman Sachs Philanthropy Fund, Morgan Stanley and the American Endowment Foundation did not immediately comment on the IPS report.

The study found that much of the money is moving between the different DAFs, with 44 of the top commercial DAFs receiving at least one grant from another commercial DAF between 2015 and 2019. On average, 33 commercial DAFs received grants from other commercial DAFs in any given year.

In 2019, the Fidelity Charitable Gift Fund became the biggest grantor to other commercial DAFs, and was the largest recipient of commercial DAF grants. Fidelity gave $448 million to a total of 29 other commercial DAF sponsors that year, while receiving $231 million in grants from 14 other commercial DAF sponsors.

Of the 52 top commercial DAF sponsors in the U.S., 39 of them filed their tax returns electronically in at least one year from 2017 to 2019. The findings in the IPS report are mostly based on these 39 e-filing DAF sponsors and don’t include any DAF granting done by sponsors that filed on paper.