Learners and employers call for more innovative accounting education

Educators aren’t fully meeting the needs of students or employers when it comes to teaching accountants and finance professionals, according to a new international analysis from the Association of Chartered Certified Accountants.

The ACCA research draws on the views of more than 800 learners and learning and development experts. The report, released Wednesday, found that educators are struggling to adapt their L&D programs to meet demands, with 39% saying the characteristics of their learners are too diverse for common principles to be included.

The report also examined the role of artificial intelligence and gamification in learning and development, with both learners and educators across all age ranges giving a low positive response rate to these technologies as a way of developing a wide range of abilities. That may be due in part to a lack of understanding of what gamification and AI are, and what the technologies can achieve, plus a possible fear among educators that the technology may be too complicated or make their role redundant.

‘The World Economic Forum estimates that by 2030, 90% of jobs will demand digital skills,” stated ACCA head of business reporting Sharon Machado, who wrote the report. “So educators need to make data and digital central to their L&D programs.”

The ACCA asked learners and educators to identify the features of a good L&D system and saw six interconnected themes:

- Relevance: Meeting learner and stakeholder needs;

- Reliability: Delivering learning outcomes that are trusted irrespective of different learning approaches for a given capability or learner;

- Motivation: Driving the achievement of the learning purpose and supporting lifelong learning;

- Person and people: Placing learners and their tutors at the heart of learning and the learning approach, at an individual, cohort and community level;

- Digital and data: Supporting the development of L&D strategy and its implementation across content, production, delivery and monitoring; and

- Sustainability: Business models employ an integrated approach to environmental, social and financial matters.

The researchers asked educators and learners for the best ways to develop core competencies and capabilities. For ethics, 61% of educators and 65% of learners said work experience or simulations were most appropriate, with gamification seen as the least appropriate. For collaboration, learning from peers and those with more advanced skills was seen as most important, at 77% for educators and 74% for learners.

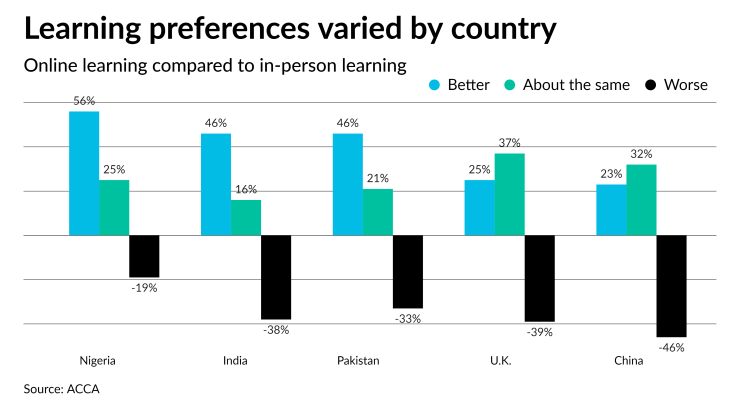

The researchers also analyzed different ways of learning, with 58% of educators and learners saying online learning was at least as good as in-person. There were some differences internationally, with respondents from Nigeria (56%), India (46%) and Pakistan (46%) rating online learning as better than in-person, compared to just 25% in the U.K. and 23% in China.

“As a result of COVID-19, there’s an even stronger expectation that learning is a 24-hour business,” Machado said in a statement. “This is a challenge for educators, with the need for continuous innovation to be core to their business strategies. Professional bodies like ACCA are part of this innovation too, and that’s why it is one of our values that drive all we do as an organization to support educators and learners too.”

The report can be found here.

U.S. colleges see declines in accounting enrollment

Some educators in the U.S. are also disenchanted with the kind of accounting education currently being offered, as the number of CPAs declines in the U.S. A report released last month by the American Institute of CPAs found that accounting graduates trended downward in the 2019–2020 academic year, with decreases of 2.8% and 8.4% at the bachelor’s and master’s levels, respectively (see story). On the other hand, new non-accounting graduates hired into accounting and finance functions increased by 10% in 2020.

Erin Steinberger, an accounting professor at Santa Monica College in California, has been seeing such trends among students who are worried about being automated out of their jobs. “We’re seeing a drop in accounting because there’s no meaningful engagement from employers about opportunities in accounting,” she recently told Accounting Today. “What we keep reading about is automation. Students are the most social media savvy generation, and all they’re reading about is how accounting doesn’t want them.”

Many students are seeing larger salaries being offered in other industries, particularly the technology field, and the declining enrollment in colleges is contributing to the shortage of talent in the pipeline.

“With that demographic decline, there’s not enough talent to go around,” said Steinberger. “The supply is tanking, and everyone needs to compete for supply like it matters to their industry. What happened at SMC recently, and it’s happening across the state, is we’re hearing from other faculty in accounting that accounting is down for the last four years, so your shortage is coming. It’s worse than what it is today. There’s less coming and people are retiring so there’s a demographic decline that’s going to eliminate supply, which doesn’t exist. This idea that there will always be talent coming, and this is just a bad year from the pandemic, people need to wake up to the reality that that’s not true. If you look at enrollment in higher ed, it’s been declining since 2015. So that means supply’s in decline.”

The accounting profession may need to do more to fund education at a time when the price of tuition is increasingly out of reach for students. The long road to a CPA certification, with its 150-hour requirement, may also be deterring students from pursuing a career in public accounting. Steinberger would like to see the accounting profession doing more to help students in community colleges get jobs in the profession.

“What’s happening to us is now that enrollment is tanking and there’s downward pressure through the demographic decline, through migration in California, through industry wars with companies recruiting and offering bachelor’s degrees for free at 18,” she said. “Everybody is losing their pipeline, and we just started laying off faculty in accounting, so you have less producers now. This is happening across the U.S. Basically every community college is in the same position that we are. They’ve all been declining from before the pandemic. Students are demanding something different. There’s a lot happening, but without meaningful engagement about where the jobs are, what you want that talent to do and how to get there, people aren’t coming. They’re not buying education. It’s not working for them. The design has been broken for a while. They can go and get a free degree and a pathway to opportunity at large companies. Accounting really needs to get together and centralize the effort to talk about what the opportunities are, make it clear what the jobs are and what it takes to get there, and that hasn’t happened.”