IRS mailing millions of letters about Child Tax Credits

The Internal Revenue Service is sending letters to over 36 million families about how they may be able to qualify for monthly Child Tax Credit payments, beginning in July.

The American Rescue Plan Act that Congress passed in March expanded the Child Tax Credit to provide families with up to $3,600 per child for 2021. The letters are going out to families who may be eligible based on information they included in either their 2019 or 2020 tax return or who used the Non-Filers tool on IRS.gov last year to register for an Economic Impact Payment. Families who are eligible for advance Child Tax Credit payments will receive a second, personalized letter giving an estimate of their monthly payment, which starts July 15.

The payment will be for up to $300 per month for each qualifying child under the age of six and up to $250 per month for each qualifying child who is between ages six to 17. The tax credits are being structured as advance payments. The IRS plans to issue advance Child Tax Credit payments on July 15, Aug. 13, Sept. 15, Oct. 15, Nov. 15 and Dec. 15. Eligible families will start to receive advance payments, via either direct deposit or check.

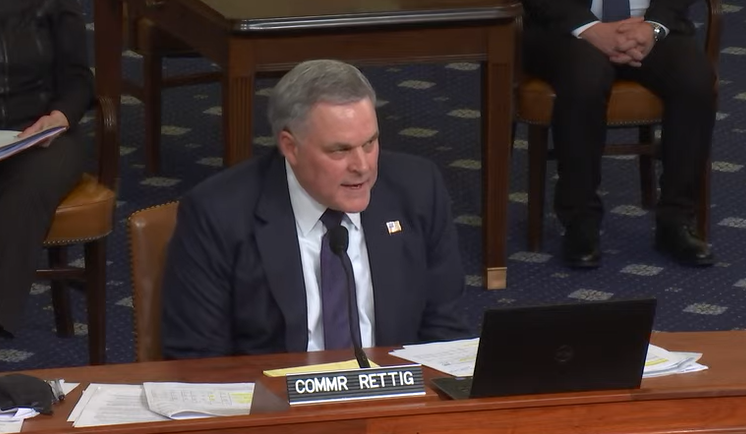

The American Rescue Plan Act raised the Child Tax Credit amount considerably and made the tax credits fully refundable in an effort by the Biden administration to reduce in half the childhood poverty rate for families. The IRS needed until July to set up the complex system. “We have to create an entire new structure for the Internal Revenue Service,” said IRS Commission Charles Rettig during a congressional hearing in April (see story). “We are not historically a benefits delivery federal agency, but we’re setting that up. The cost for that program is $391 million. Right now it will be — and this is my educated guess — a minimum of 300 to 500 people, which includes folks that will have to handle the phone service, because we’ll have to increase phone service. The Taxpayer Advocate Service will get additional touch points.”

For tax year 2021, families claiming the CTC will receive up to $3,000 per qualifying child between the ages of six and 17 at the end of 2021. They will receive $3,600 per qualifying child under the age of six at the end of 2021. Under prior law, the amount of the CTC was up to $2,000 per qualifying child under the age of 17 at the end of the year.

Most families won’t need to take any action to obtain the payments, the IRS noted. Normally, the IRS will calculate the payment amount based on the 2020 tax return. But if that return isn’t available, either because it hasn’t been filed yet or hasn’t yet been processed, the IRS will instead determine the payment amount using the 2019 return.

The IRS is encouraging individuals and families who haven’t yet filed a 2020 return — or a 2019 return for that matter — to file as soon as possible so they can get any advance payment for which they’re eligible. Filing soon will also help the IRS make sure it has their most current banking information, along with key details about qualifying children. That includes people who don’t normally file a tax return, such as families experiencing homelessness, the rural poor, and other underserved groups.

For most people, the fastest and easiest way to file a return is by using the Free File system that’s available on IRS.gov.

Throughout the summer, the IRS plans to add more tools and online resources to help with the advance Child Tax Credit. One of the tools will allow families to unenroll from receiving the advance payments and instead receive the full amount of the credit when they file their 2021 return next year.

Later this year, individuals and families will also be able to visit IRS.gov and use a Child Tax Credit Update Portal to notify IRS of changes in their income, filing status, or number of qualifying children; update their direct deposit information; and make other changes to ensure they are receiving the right amount as quickly as possible.

The Child Tax Credit Update Portal will initially allow anyone who has been determined to be eligible for advance payments to unenroll or opt out of the advance payment program. Later this year, the portal will enable people to check on the status of their payments and update their information, and it will be available in Spanish. More details will be available soon about the online Child Tax Credit Update Portal.

In the meantime, the IRS has created a special Advance Child Tax Credit 2021 page at IRS.gov/childtaxcredit2021 that will provide the most up-to-date information about the credit and the advance payments. In the next few weeks, the page will also provide other useful online tools, including an interactive Child Tax Credit eligibility tool to help families see if they qualify for the advance Child Tax Credit payments.