Helping Small Business Clients Maximize Extra Cash

When it comes to maximizing cash flow for small businesses, the Mining Your Business method consists of breaking your client’s operation down into two separate categories: cash generating activities and cash conversion activities.

By understanding the difference between the two you can help illuminate problems that exist in the way your clients sell goods or services and collect and spend the money they earn. It connects the income statement to the balance sheet to give a very holistic view of the way money moves through the business.

The steps to Mining Your Business are:

1. Calculate your company’s cash generating and cash conversion ratios.

2. Compare your company’s results to another number like the industry average or a desired goal you have for yourself. This is also known as the Target Ratio.

3. Convert the comparison of the two numbers to a financial impact dollar amount.

Calculate Your Ratios and Compare Them to Your Target Ratios

I usually combine the first two steps for speed. This means I have already determined my Target Ratios and am ready to compare my new calculations to these Targets.

The one thing to remember about ratios is that they don’t mean anything unless you compare them to something else. Other than that, it’s just a number.

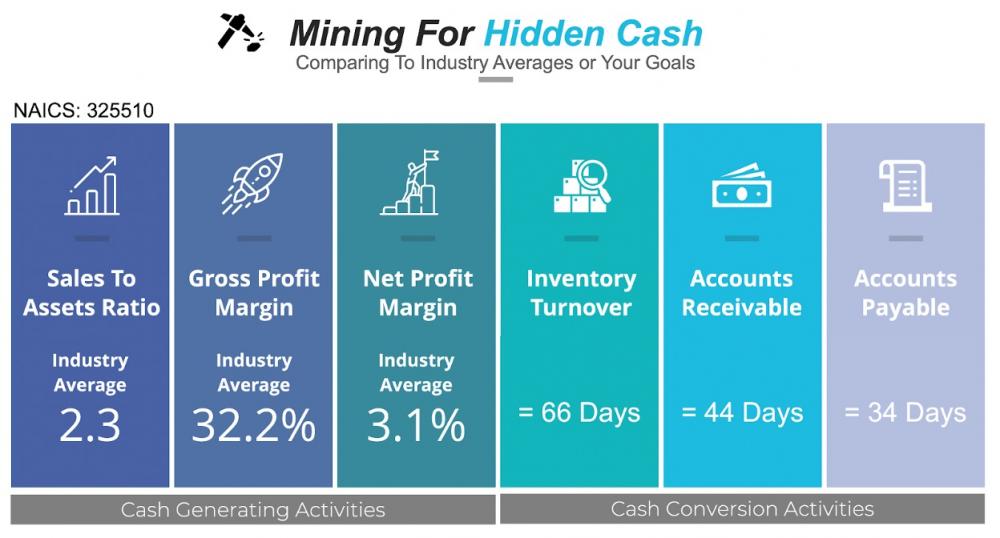

In the case I prepared for this article, I used the industry average for paint manufacturing companies, NAICS code 325510. Here were the results I gathered:

In the chart above, you can see that I use six different calculations, three cash generating activity ratios and three cash conversion activities.

Cash Generating Activities – determine how efficiently you use your assets and control expenses to generate cash.

● Sales To Assets Ratio

● Gross Profit Margin Percentage

● Net Profit Margin Percentage

Cash Conversion Activities – determine how efficiently you balance cash inflows and outflows within your business operation.

● Inventory Turnover Ratio

● Accounts Receivable Ratio

● Accounts Payable Ratio

The next two images describe how to calculate these ratios.

CASH GENERATING ACTIVITIES

As you can tell, I first calculated the results for a company and then compared them to the industry average at the bottom of the page. In the final step, calculating financial impact, this step is crucial.

When I’m explaining these calculations and their importance to my clients, I phase the explanation like this:

1. Sales To Asset Ratio: “This ratio lets you know how much money in sales your stuff generates compared to how much you paid for it. For example: your Sales To Assets Ratio is a 1.98. That means for every dollar you spent on your equipment, it generates $1.98 in sales.”

a. It helps to convert this ratio to a dollar amount for better comprehension.

2. Gross Profit Margin: “This is the most important number on the income statement. It is the only place you can generate cash to pay your expense or keep in your pocket. If you bought a shirt for $50 and sold it for $100, you would have a 50% gross profit margin. The difference in these two numbers is used to pay your bills and when they are paid, you get to keep the rest.”

3. Net Profit Margin: “This number tells you if you have a viable business. Does your business model work, meaning how much is left from my sales after I pay my bills.”

a. You have to remember there is no advice you can give to improve net profit. It is only a result. You have to improve one of these three categories: Sales, Cost of Sales, and/or Operating Expenses.

CASH CONVERSION ACTIVITIES

Here is how to explain the cash conversion ratios to your clients:

1. Inventory Days: “This is the amount of time that a piece of inventory sits on the shelf. The longer your inventory is sitting on the shelf, the more money you will need to run your company. Think of it as piles of money sitting on a shelf that you can’t use until someone else wants it. That is money you can’t use to pay bills or yourself. So, you don’t want a lot of money sitting on the shelf.”

2. Accounts Receivable: “This is a measurement of how fast your customers pay their invoices. You want this to be a small number, meaning you aren’t waiting as long for money to come in.”

3. Account Payable: “Just like we measure how fast customers pay you, we also need to measure how fast we pay our vendors. This one is a double edged sword. Pay too soon and you could be hurting the cash flow of your company, and paying too slow you might hurt your vendor relationships or put your company at a disadvantage. We want this number to be around the industry average. That way, if we need to make an adjustment by waiting a week to pay an invoice, we can.”

Convert Your Calculations to a Financial Impact Amount

Even though you can see where you might be ahead or behind your Target Ratios, this step brings the message home. When you apply a dollar amount to the difference, you see where you should focus your attention.

It tells you where the BIG problems are. In the next images, I calculated the Financial Impact of each ratio by using a calculation that asks the question: “What If My Company Was Like My Target?”

The results are clear that this company has three opportunities. They can increase sales by $1.3m without adding new equipment. Their pricing strategy is below the market, meaning that they are making about $126K less than their competitors.

Finally, they need to cut expenses by about $122k to be comparable to their competitors. How do I know? The Net Profit Margin calculation shows that our sample company makes $248k less than other companies in the same industry.

However, you have to remember that the average company also makes $126k more in Gross Profit. This means that the Net Profit calculation already includes more gross profit dollars. Operating expense is the only place we can make a difference.

In the cash conversion calculations we found only one opportunity and found out that the sample company is great at collecting from our customers and paying our vendors. The one opportunity we found was the amount of inventory this company has. We have too much inventor, $383K worth to be exact.

By reducing inventory, we can add that much back into our cash flow by NOT using that money to re-order. Just run it down lower. We also found out here that the sample company collects faster than our competitor which gives us access to $239K faster than they do.

Lastly, we found out that the vendors of this company allow them to pay slower without penalty. This keeps $350k in our bank account that competitors have already used to pay bills.

Summarize Your Findings With Your Client

Nobody wants to look at a wall of numbers. Data visualization or Data Storytelling can do most of the heavy lifting for you.

Here is how I would summarize the results of our calculations. The focus of the graph is to highlight everything in RED. The more RED you see the more opportunities your clients have to recapture their own cash.

This is a graph of our findings. The red areas should indicate the priority of work for your client. If they don’t know where to start, just look for the longest red line and focus there. Here are the action items I would recommend to this sample company.

Action Items

1. Increase Sales. “You have enough capacity to process more sales without making another investment. Let’s work on a sales plan.”

2. Improve Gross Profit. “The calculations show that a 1.5% increase in gross profit would give us an additional $126k. Let’s look at pricing or our goods and/or negotiating with vendors.”

3. Improve Net Profit. “You have to remember that Net Profit is just a result. The opportunity I see here is in cutting operating expenses. Let’s look where we can save $122K per year.”

4. Reduce Inventory. “I think we have about $383k in too much inventory on the shelf. It’s money we already used to buy it. Let’s clearance our slow movers and reduce the amount on the shelf and put that cash back in the bank.”

Final Thoughts

Based on our sample company, $1.9M is leaking through the inefficient use of their resources and business processes. This simple technique can help your clients maximize the use of every dollar that comes through their business and generate extra cash for them.

Put you and your clients on The Clear Path to Cash and start building lifestyle friendly businesses.

| It’s clear that your clients’ need help to manage their cash flow. Take your business capabilities a step further by developing an overall firm strategy that addresses small business clients’ cash flow issues. In this white paper you can learn the angles to take to solve these challenges, build that cash flow strategy, and approach your clients’ learning curves to bring them closer to finding the hidden cash. |