Goodwill impairments surged during pandemic

The total value of goodwill impairments recorded by U.S. public companies more than doubled in 2020 during the first year of the COVID-19 pandemic, according to a new study, and the same may happen again this year as geopolitical tensions rise.

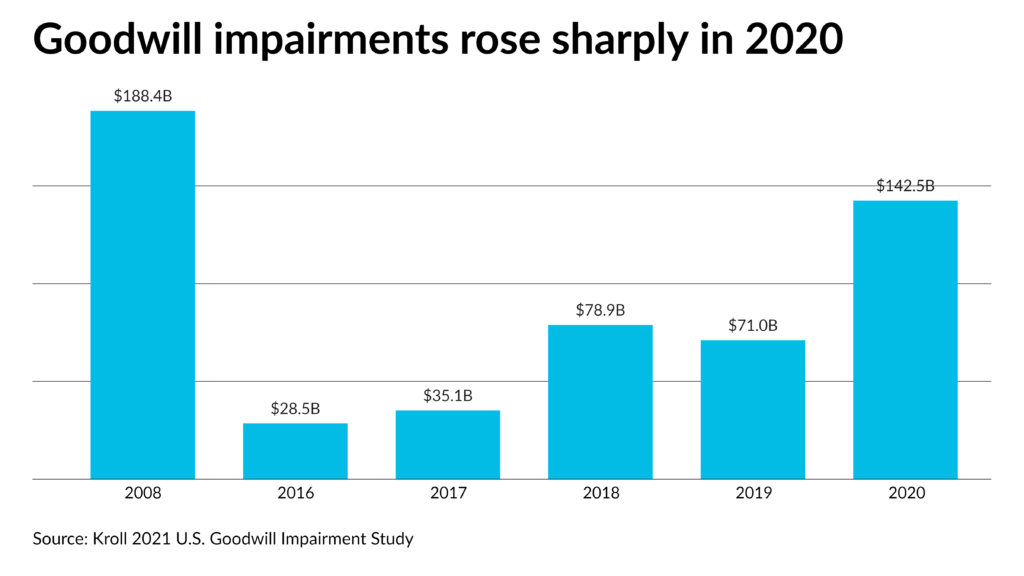

The study, released Thursday by Kroll’s Valuation Advisory Services practice, found total goodwill impairments surged from $71.0 billion to $142.5 billion between 2019 and 2020 amid the pandemic, but the amount fell short of the $188.4 billion level in 2008 at the beginning of the global financial crisis. The number of goodwill impairment events also increased 45%, from 318 in 2019 to 462 in 2020, but that figure was still below the 502 events observed in 2008. Average goodwill impairment per event rose to $308 million in 2020, the second-highest level since the record in 2008 of $375 million.

The findings indicate that the accounting fallout from the global pandemic has not been as drastic as seen during the financial crisis, as markets quickly recovered and many companies saw huge profits thanks to generous government stimulus programs. Quick actions from the Federal Reserve and the U.S. government limited the magnitude of goodwill impairments that otherwise probably would have been observed, particularly when compared to 2008 levels.

“Unprecedented levels of fiscal and monetary support allowed many businesses to bounce back from the plunge in economic activity that followed the COVID-19 outbreak, with the S&P 500 index recovering dramatically from its low point in March 2020,” said Carla Nunes, managing director in Kroll’s Office of Professional Practice and a Kroll Institute Fellow, in a statement. “Consistent with these trends, our preliminary data for 2021 points to a sharp reversal in goodwill impairment activity.”

Eight out of the 10 industries analyzed in the annual study saw their goodwill impairment increase or remain at similar levels in 2020, with the exception of the consumer staples and health care sectors. Energy goodwill impairment surged nearly five-fold to an all-time high of $41.7 billion, due to plunging global oil demand and other events that led to a collapse in oil prices. The communication services industry experienced a record number of impairments in 2020 and an aggregate impairment amount of $27.5 billion, the highest level seen since 2007. Several companies continued to struggle with intense competition and changes in consumer preferences, further exacerbated by COVID-19 related issues, such as content creation delays and venue shutdowns.

Goodwill impairment in the financial and real estate sector skyrocketed 43-fold to $19.1 billion in 2020, the highest level since 2008, as shuttered properties squeezed real estate companies, while an increase in credit losses and further declines in interest rates (brought on by COVID-19 monetary policies) led to a compression in financial institutions’ margins.

This year, investors may be focusing again on goodwill impairment as an important factor in their analysis. Geopolitical risks from Russia’s invasion of Ukraine are dampening global economic prospects, while inflationary pressures are prompting the Federal Reserve and other major central banks to raise interest rates. The resulting increase in the cost of capital and the potential deterioration in the global economic outlook could well raise goodwill impairments again in 2022.

Both the Financial Accounting Standards Board and the International Accounting Standards Board are discussing a change in goodwill accounting, moving away from impairment to only amortization, but many investors would like to see a unified approach from both FASB and the IASB, according to a survey released last December by the CFA Institute (see story).

“Standard-setters must perform an appropriate cost-benefit analysis and ensure that any change will meet the criteria (i.e., enhancing the decision-usefulness of financial statements) before making a financial reporting change,” said a report on the survey by Sandy Peters, senior head of financial reporting policy at the institute. “Currently, the FASB is trending toward a move to amortization with a 10-year default amortization period, and the IASB is moving toward retaining impairment with an improvement in disclosures.”

Standard-setters as well as investors will need to keep a close watch on the goodwill impairment numbers this year. “Robust and timely information about goodwill impairments of U.S. companies has never been more important to investors than it is today,” Nunes said in a statement. “U.S. companies faced an exceptionally high level of uncertainty created by COVID-19 and the ensuing economic crisis, which prompted significant changes to their earnings outlook and associated risk. The impairment levels recorded as a result of the pandemic demonstrate that the current goodwill impairment-only model captures the changes in business outlook, as intended by accounting standards.”