Client Experience Tools, Technology & Processes

Whether you are dealing with tax or Client Accounting Services engagements, your client experience should be considered in all areas of your firm. You need to have the best possible experience for your clients and your firm’s staff, while maximizing profit to the partners. Effective document exchange, gathering, management, and distribution with clients is a significant friction point for many firms.

What is the Best Tech Stack to Work with Clients?

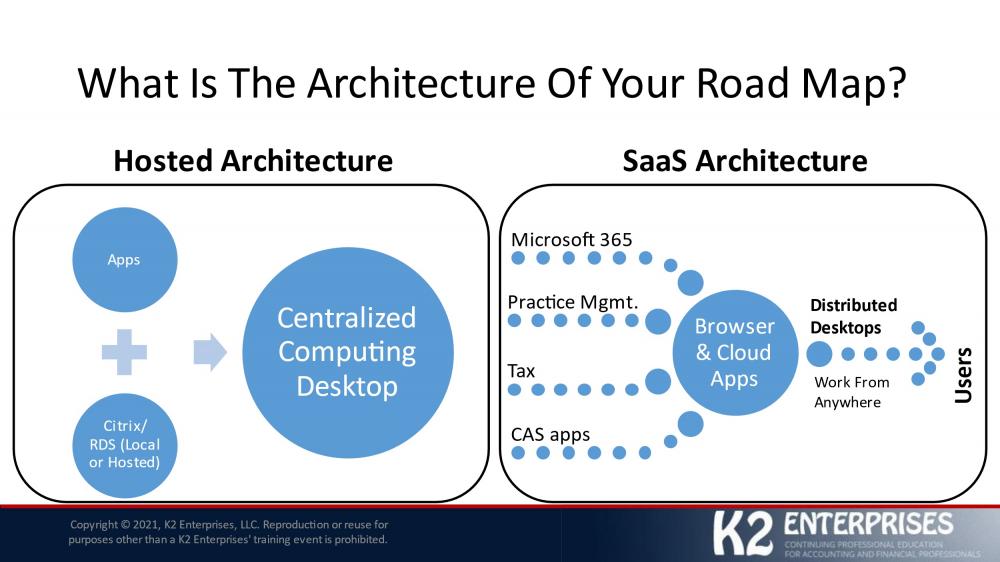

With the shift in technologies to a cloud/SaaS architecture, many firms will need to reexamine their current strategy, which is likely a premise-based LAN, or hosted by a provider.

Artchitecture of Your Road Map

Since many of the major suite providers do not have a complete solution, the need for CAS tools forces firms to take a best-of-breed approach.

When choosing a tech stack, start by choosing a platform that fits your clients. Once you pick an ecosystem, you should focus on that platform.

● Choices today for CAS technology stacks include:

o QuickBooks Online

o Xero

o Gravity

o Accounting Power

o AccountingSuite

o Sage Intacct

Next, decide on the services you’ll provide. Here are some to consider:

● Services that are required for compliance or to operate:

○ Sales tax

○ Payroll

○ Bill Payments/Accounts Payable

● Services that minimize the pain to the business owner:

○ Expenses

○ Time Entry

○ Document Management

○ Document Gathering

● Reporting:

○ Forecasting

○ Financial Reporting

○ KPIs

● Finally, consider tools that minimize the pain for your team with automation:

○ Data Import

○ Robotic Process Automation (RPA)

○ Pre-accounting

○ Digital plumbing (like Zapier)

Lastly, build a grid with your options. Contact others in your business circles for guidance. Read reviews. Select three products in a category for in-depth review. Track your options in a spreadsheet (example below). Build your procedures. And finally, offer that service category to your clients.

Maintaining Client and Team Member Experience with Security

If you only take away one idea from this article, it should be that your client experience is important! However, to get the right client experience and team member experience, we must pick the right tech stack and have a strong vision. Client Experience 2.0 drives Firm Experience 2.0.

So how do we create an efficient and delightful Client and Team Experience? What makes client interactions with your firm easy and minimizes the effort for your team? How do team members get things done effectively year-round? The key is to close the “air-gap” between your clients and your systems.

Build a Client Experience 2.0 “Air Gap” Scorecard to see how your firm is doing.

● First, write down where your firm is today regarding portal adoption (e.g., 25%)

● Then write down where your clients are regarding smartphone adoption ( e.g., 90%)

● The delta is the gap

Every client in that gap represents inefficiency, poor client experience, and risk:

● Inefficiency – The problem for the firm is especially acute as staff must split time between multiple processes (send to portal — when that fails, they move to email, text, etc.)

● Poor client experience – clients with smartphones expect great technology. If they aren’t using your current solutions, they are sending a signal

● Risk – the secondary means of communication (email, text, etc.) are vulnerable on both sides

Compare to Best of Breed

● Top performers do not have gaps (e.g., all financial institutions, digital-first firms)

● In a post-COVID world, firms need a clear digital strategy to match client expectations — and the gap analysis offers a quantifiable yardstick to understand how well the firm is doing

What Can Firms Do To Close This Air Gap?

Outside your busy season is a great time to focus on the relationship between “making things easy” and “getting things done.”

● To create a great client experience, you need to recognize that clients want Easy. Clients should be able to respond to requests quickly, completely, and easily, without being frustrated. Low portal adoption rates, having to frequently hound clients for documents, and being asked to resend documents all indicate that you’ll benefit from upgrading your digital front-office.

● A great client experience goes hand-in-hand with firm efficiency. When your team receives the information they need from clients on time, they can do their best work.

● Team Member Experience should be equally frictionless. Your team should have all the information and documentation needed to do a project and to collaborate with clients and firm staff. There should not be restrictions about where and when Team Members work.

There are security considerations of Client Experience 2.0, too. How do we keep digital documents secure in this new, interactive, collaborative world?

Users will be using web browsers, mobile devices, and frequently not have sophisticated IT skills or support. The tools we choose must be secure, have native Multi-factor Authentication (MFA), and provide Single Sign On (SSO), OAuth, or passwordless capability. Further, client and team member expectations are that we are connected and that all data is secure and encrypted, even if they don’t know what that means!

We must therefore select the right tools to manage risk when exchanging sensitive client information. To do that, select and use fewer tools, verify the security of all tools used, enforce MFA, have control procedures on critical tasks and deadlines, and encrypt in transit and at rest. Further, we can control the practice with proper Practice Management/Workflow. Turn on MFA everywhere. And of course, never communicate insecurely over email or text.

Managing Risk – Consider the Following Tools:

● Secure document gathering / communication tools like Liscio

● Reporting tools like Fathom, Spotlight, or Jirav

● Security tools like MFA and Single Sign On

● Workflow tools like Karbon

● Cashflow tools like LivePlan

● Encrypted storage tools like SmartVault

To sum up, focus on finding secure tools that minimize friction for clients, so that your team can efficiently receive and handle the client’s sensitive information. All boats rise when you make things easy for clients to securely work with your firm.

In part 2 of this article, we will examine how CAS can drive Advisory, and how to leverage a Client Experience 2.0 model to knock it out of the park with your clients and your staff.

| At Liscio, we’re dedicated to the craft of client experience. We believe the right client experience speeds the exchange of data between firm and client, minimizes wasted motion, and creates raving fans. Liscio’s platform achieves these goals by putting all of the tools client’s need to respond quickly right at their fingertips — including an all-in-one mobile app, automatic reminders, and even a mobile document scanner. With all client communications and documents centralized in Liscio, it’s easy for staff to quickly see what is going on with each client’s account. And since Liscio is so easy for clients to use, they send documents quickly when asked. No more data silos, no more chasing clients for documents, and no more searching across multiple platforms.To see how Liscio can help you provide a world-class experience for your clients and staff, book a personalized demo. |