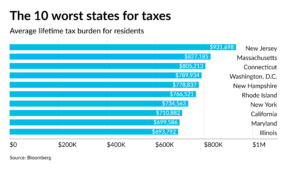

N.J. residents pay the most in lifetime taxes, W. Virginians the least

Residents of New Jersey, Massachusetts and Connecticut will face the highest tax burdens over a lifetime, according to a new study. Those living in New Jersey will pay on average a grand total of $931,698, well above the $827,185 for Massachusetts residents and $805,213 for Connecticut. Nationwide, Americans will pay