G-7 strikes deal to revamp tax rules for biggest companies

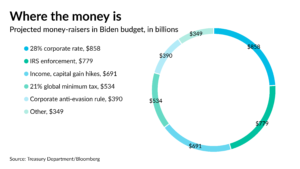

The Group of Seven rich nations secured a landmark deal that could help countries collect more taxes from big companies and enable governments to impose levies on U.S. tech giants such as Amazon Inc. and Facebook Inc. The agreement by the G-7 finance ministers in London satisfies a U.S. demand