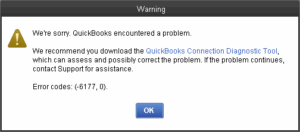

How to Permanently Stop QuickBooks Error -6177 0?

One of the most common error user usually faces is QuickBooks error 6177 0. Whenever you create a new company file in QuickBooks, it gets saved in the company file folder whereas the path of the company file gets saved in QuickBooks. When you try to access the company file,