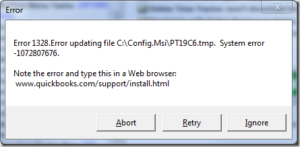

Quick Troubleshooting Guide to Fix QuickBooks Error 1328

If you are facing issues updating, repairing, installing, or uninstalling QuickBooks Desktop application, then you might have encountered QuickBooks error 1328. As there are several reasons that trigger this error in the application, error 1328 is one of the most common errors encountered by the QuickBooks users. However, troubleshooting this