How to Reset QuickBooks Password the Right Way

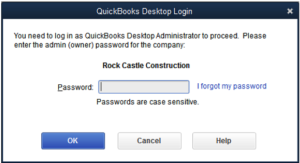

At times, you might need to reset or remove the password from the QuickBooks company file. Due to the increasing number of cyber security threats, QuickBooks takes vigorous measures to protect user’s data, and QuickBooks Automated Password Recovery Tool is the only way to reset the QuickBooks password that is