Advance CTC payments may be making a dent in hunger

Even as the Internal Revenue Service began sending out the second batch of advance Child Tax Credit payments, evidence has emerged that the first round may have had a measurable impact on hunger and poverty in the U.S.

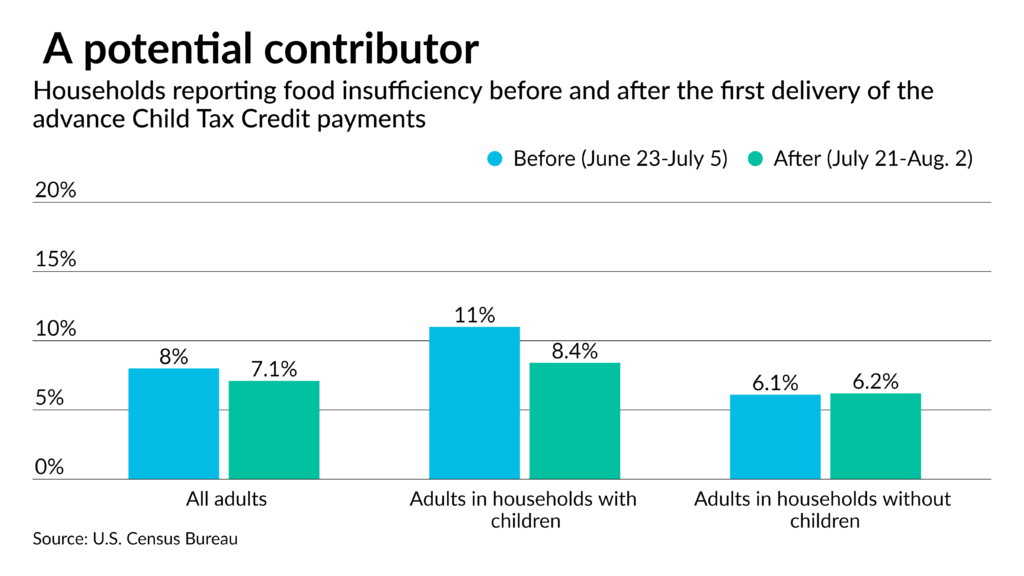

The Census Bureau reported Friday that according to two Household Pulse Surveys that it conducted — one just before the first tranches of advance payments went out on July 15, and one just after — adults in households with children reported a 2.6 percentage point drop in food insufficiency, and a 2.5 percentage point drop in difficulty paying their expenses.

While the Census Bureau pointed out that the survey did not prove that the advance payments were responsible for the drops, it did note that adults in households without children — who would not be eligible — reported slight increases in food insufficiency and difficulty in paying their expenses.

Round 2 for the IRS

Also on Friday, the IRS started sending out the second tranche of payments to approximately 36 million taxpayers.

Most the roughly $15 billion in August payments will be delivered by direct deposit, but the service did note that a small portion of those who received a direct deposit payment in the first round will receive paper checks in the mail. The issue, which is expected to be resolved by the September round of payments, should impact less than 15% of taxpayers.

Families can check to see if the issue will affect them at the Child Tax Credit Update Portal. Taxpayers who received their first payment by check can also use the portal to get future payments by direct deposit.

The payments, which were established under the American Rescue Plan, will be sent out monthly for the rest of the year, on September 15, October 15, November 15 and December 15.

The IRS also noted that eligible taxpayers who didn’t receive a payment on July 15 will still receive the full amount of the credit, but it will be spread over five months, instead of six.

Low-income families can still sign up to receive the payments; they can check to see if they qualify by using the IRS’s advance Child Tax Credit Eligibility Assistant.

Those receiving payments can also unenroll any time they like — for instance, if they think they may no longer qualify for the credit when they file their 2021 return — using the CTC Update Portal. For married couples, each spouse must unenroll separately.