5 Things to Look For in a Payroll and HR Provider

Because payroll and HR providers offer such a wide range of services, you can now choose a solution provider that not only takes the friction out of the process, but also fulfills your clients’ needs.

Today, firms have more choices when it comes to payroll with four basic models—outsourcing, in-house, hybrid and holistic—that offer a range of options. (You can learn more about the four payroll models in this article.)

Considering that payroll is one of the stickiest (monthly client contact, at the least!) and most valuable services an accounting firm can offer, that’s excellent news for practitioners. Suppose the majority of your clients don’t need the full-service payroll and benefits administration of a PEO (professional employer organization). In that case, a wholesale small business solution like RUN Powered by ADP® Payroll for Partners or a mid-market option like ADP Workforce Now® may be a better fit.

Whatever payroll and HR solution providers you consider, there are certain features you’ll want them to offer. Here are the five things we advise our members to look for:

1. They’re Modern

Modern firms need modern solutions. If the companies you’re vetting don’t offer cloud-based operation and browser-based access, keep looking. From security concerns to software updates to remote operation, a cloud-based provider must be able to provide you with the peace of mind that comes from knowing you can continue to operate in any circumstance.

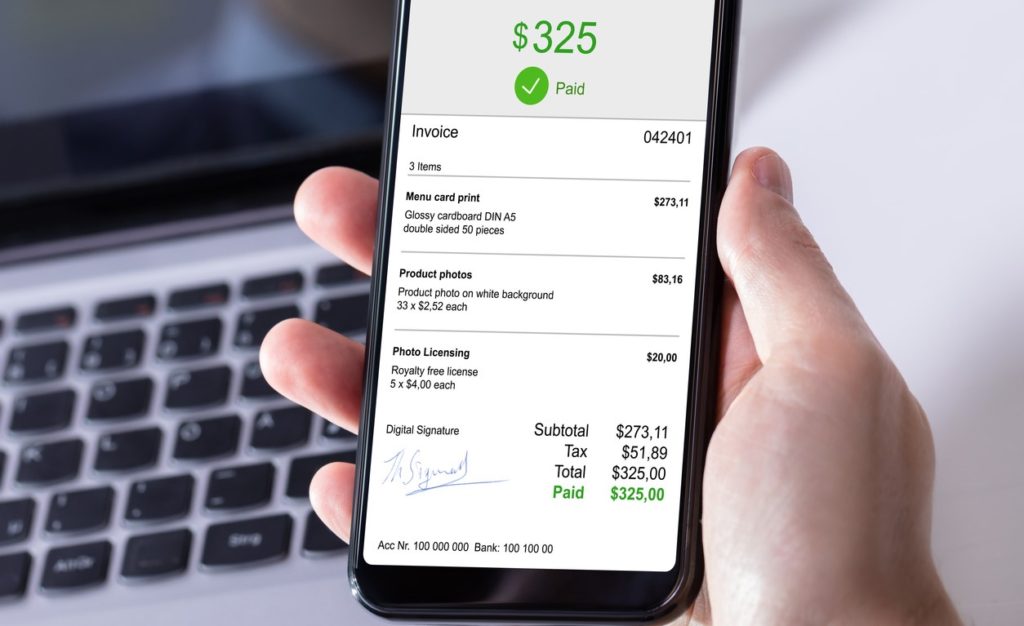

Another must-have is mobile access that extends all the way through the process to your clients’ employees. Mobile devices are the computers of choice for an entire generation of workers, so make it easy for them to onboard, record time, make changes to their profiles, and access payroll and benefits information.

2. They Provide an Incredible Customer Experience

Mom and Dad always said, “You only get one chance to make a first impression.” That’s as true for a business as it is for a person. Look for payroll and HR solution providers that are transparent, accessible and will go as many extra miles as needed for you and your clients. Other things you’ll want to include are a solid onboarding program, a library of helpful resources, and accessible expert support.

It’s not a bad idea to ask for references, so you can talk to an actual user to see whether that great first impression carries all the way through the relationship.

3. Their Technology is Built For Accounting Firms

There’s a reason one of the most powerful selling points of accounting technology is “Designed by accountants, for accountants.” Payroll, HR and tax laws are mind-bendingly complex. Out-of-the-box software that claims to adapt to any industry won’t cut it.

You’ll want technology that’s optimized for the unique needs of accounting firms. This means, solutions that are built and maintained by a company with a thorough understanding of how their solution will positively—or adversely—affect a firm’s workflow.

4. Their Technology Easily Integrates With Other Client Accounting Solutions

Given the staffing challenges our industry faces, one of the most effective ways for a firm to cope is by automating routine tasks—freeing up your staff’s time for more complex work. The repetitive nature of payroll makes it an ideal candidate for automation.

However, automation requires close and careful integration with the rest of your technology stack. You’ll want to select a provider that’s thoroughly familiar with the tools used by accounting firms. It also helps if the provider has solid relationships with the tax and accounting product and service vendors you use, so they can stay abreast of any changes and developments that could affect your workflow.

5. They Offer Dedicated Support and Training

The payroll and HR solution’s help desk and support representative will be your first line of defense when something goes awry, whether it’s a login issue or a major disruption. You’ll want to be sure the support team is not only knowledgeable, but also available on your schedule, not just on theirs.

Equally important? The availability of comprehensive, accessible training options and resources. Some solution providers have even developed certification opportunities that lend staff an extra level of authority.

Other Considerations

Before you vet payroll and HR solutions providers, take time to put some deep thought into what you want your payroll business to look like, along with your clients’ makeup and potential makeup. If the majority of your current clients are small businesses, that makes your selection easier now. But (there’s always a “but,” isn’t there?), what will you do when the perfect mid-market client or a client who’s more suited to a PEO walks through the door?

That’s why you also need to look for scalability. Given the complexity of payroll regulations, it’s true that a single software application can’t cover everything from small businesses to enterprise-level companies. But…(there’s that word again), if your solution is scalable, that changes the game—and your payroll services become even more profitable. That, in turn, builds your recurring revenue. And that builds the value into a segment which will return one of the highest values—if not the highest—when you eventually start to plan your business exit strategy.

| ADP® partners with forward-thinking accounting professionals who value being essential to their clients’ success. We offer the most flexible partner models, powered by quick & easy insights from the most complete set of payroll, HR & benefits solutions – all backed by dedicated expert support. Our Accountant ConnectSM Certification Course provides an in-depth working knowledge of the tools & resources inside Accountant Connect to help modernize your payroll process, improve firm efficiency and strengthen your advisory services. |