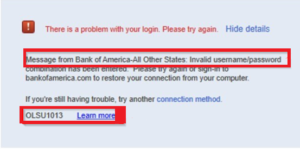

Don’t Panic! 3 Ways to Fix QuickBooks Error OLSU 1013

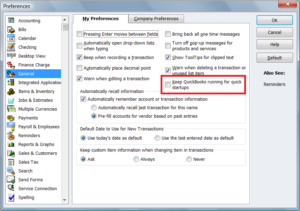

QuickBooks online banking allows QuickBooks Desktop users to connect with their financial institutions to view and download the latest transactions and to use the banking services. While using the online banking in QuickBooks, you might encounter various errors and this happens if the banking is not set up properly in