How to Troubleshoot Error 213 in QuickBooks Desktop

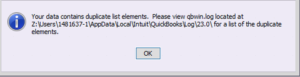

QuickBooks users often require running Verify Data utility to find and repair discrepancies and damage in the data file. Some users have reported getting error 213 while running QuickBooks verify data utility and in this article, we are going to clarify the exact reason for getting QuickBooks Error 213 along