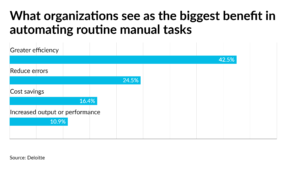

RPA on the rise in accounting

Robotic process automation has become a necessary technology for many accounting firms that are trying to achieve more efficiency as the staff becomes harder to find during the ongoing pandemic. Firms like Deloitte are increasingly relying on RPA technology and showing clients how they can achieve more with an already