2018 Tax Reform Changes: What You Need To Know

The recent Major tax reform bill that was approved under President Trump, called the Tax Cuts and Jobs Act (TCJA), last December 22, 2017. The IRS is working on implementing this major tax legislation that will affect both individuals and businesses. This is the most significant tax legislation to be enacted since 1986.

As taxpayers consider the recently enacted tax reform act, subsequent Treasury Department guidance and potential legislative technical corrections, you may find it difficult to sort out what changes actually may mean to your specific tax situations and what you should be doing now to plan ahead and keep as much money as possible in your pocket.

No need to worry Aber CPA has got you covered.

Highlights

The new legislation makes fundamental changes to the Internal Revenue Code that will upend the way individuals and businesses calculate their federal income tax liability, so as to create numerous planning opportunities.

The changes affecting individuals include:

- new tax rates and brackets,

- an increased standard deduction,

- elimination of personal exemptions,

- new limits on itemized deductions (state taxes, mortgage interest),

- and the repeal of the individual mandate under the Affordable Care Act.

The changes affecting businesses include:

- a reduction in the corporate tax rate,

- increased expensing and bonus depreciation,

- limits on the deduction for business interest,

- and a new 20% deduction for pass-through business income.

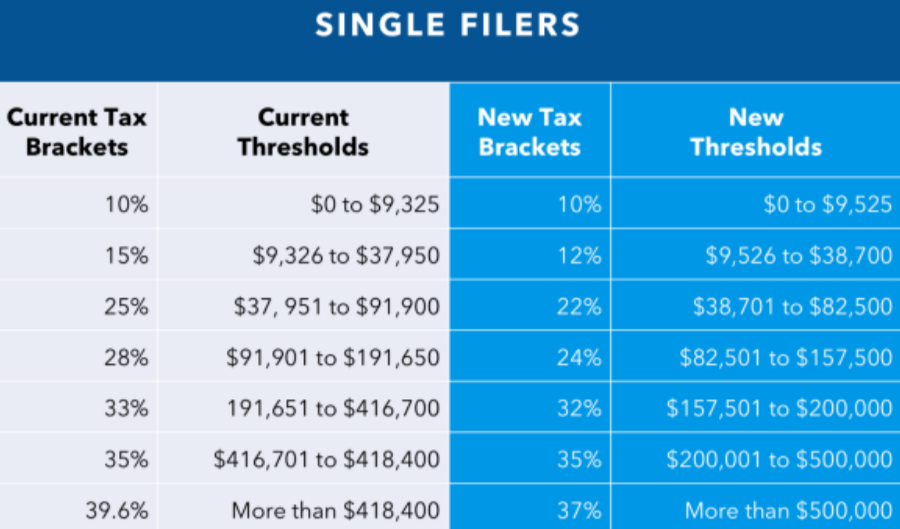

Lower Tax Rates and Changed Income Ranges

The bill retains the seven tax brackets found in current law but lowers a number of the tax rates. It also changes the income thresholds at which the rates apply.

The income thresholds at which these brackets kick in have changed, as well.

For married joint filers:

Alternative Minimum Tax Exemptions Increased

Alternative Minimum Tax Exemptions Increased

The bill also eases the burden of the individual alternative minimum tax (AMT) by raising the income exempted from $84,500 (adjusted for inflation) to $109,400 married filing jointly and from $54,300 (adjusted for inflation) to $70,300 for single taxpayers, so fewer taxpayers will pay it.

Relief for Individuals and Families

Increased standard deduction:

The new tax law nearly doubles the standard deduction amount. Single taxpayers will see their standard deductions jump from $6,350 for 2017 taxes to $12,000 for 2018 taxes (the ones you file in 2019). Single filers with at least one qualifying child would receive an $18,000 standard deduction.

Married couples filing jointly see an increase from $12,700 to $24,000. These increases mean that fewer people will have to itemize. Today, roughly 30% of taxpayers itemize. Under the new law, this percentage is expected to decrease.

Increased Child Tax Credit:

For, families with children the Child Tax Credit is doubled from $1,000 per child to $2,000. In addition, the amount that is refundable grows from $1,100 to $1,400. The bill also adds a new, non-refundable credit of $500 for dependents other than children. Finally, it raises the income threshold at which these benefits phase out from $110,000 for a married couple to $400,000.

Eliminations or Reductions in Deductions

Personal and dependent exemptions:

The bill eliminates the personal and dependent exemptions which are currently $4,050 for 2017 and were expected to increase to $4,150 in 2018.

Miscellaneous itemized deductions:

The deduction of miscellaneous itemized deductions subject to the two percent floor has been suspended. Thus, for example, investment advisory fees, tax return preparation fees and employee business expenses will be non-deductible.

Alimony:

Starting in 2019 alimony will no longer be deductible to the payer and will not be income to the recipient. Existing alimony or separation agreements are grandfathered.

Estate Tax:

Under the Tax Cuts and Jobs Act, the basic exclusion doubled from $5 million to $10 million (indexed annually for inflation) for estates of decedents dying and gifts made after 2017 and before 2026. In 2018, the exemption is a projected

$11.18 million (pending final IRS guidance).

State and local taxes:

The bill limits the amount of state and local property, income, and sales taxes that can be deducted to $10,000. In the past, these taxes have generally been fully tax deductible.

Home mortgages:

The bill also caps the amount of mortgage indebtedness on new home purchases on which interest can be deducted at $750,000 down from $1,000,000 in current law. Acquisition indebtedness incurred on or prior to December 15, 2017, will be grandfathered up to $1 million. Interest on home equity debt is suspended and is not grandfathered. This change in the deduction of interest expense on a qualified residence will have an impact on the real estate market in those areas with high housing costs. A qualified residence for these purposes includes the principal residence of the taxpayer and one other residence of the taxpayer selected by the taxpayer and used as a residence.

Health care:

The bill eliminates the tax penalty for not having health insurance after December 31, 2018. It also temporarily lowers the floor above which out-of-pocket medical expenses can be deducted from the current law floor of 10% to 7.5% for 2017 and 2018

So for 2017 and 2018, you can deduct medical expenses that are more than 7.5% of your adjusted gross income as opposed to the higher 10%.

Tax reform readiness: What’s your business strategy?

The implications of tax reform are just getting started and will have a lasting impact. Prepare your business today for tomorrow’s tax function.

Business and Corporate Changes

Corporate tax:

The bill has a myriad of changes for business. The biggest includes a reduction in the top corporate rate previously of 35% to 21% which is permanent unlike the individual tax cuts which are set to expire in December 21,2025. Personal service corporations—like healthcare, law, accounting, consulting, financial services, actuarial sciences, performing arts, and athletics—which have historically been subject to some of the highest tax rates—are now taxed at the same rate as other C corporations, 21 percent. The corporate alternative minimum tax (AMT).and Domestic Production Activities Deduction (DPAD) are gone, but Research Tax Credits live on. While NOL carrybacks are gone and there is generally an 80-percent limitation on the use of certain carryforwards, they can now be carried forward indefinitely.

Self-employed “Pass Through” businesses:

Potentially massive tax benefits to businesses changing their current choice of entity. A new 20% deduction for incomes from certain type of “pass-through” entities (partnerships, S Corps, sole proprietorships), who pay their share of the business’ taxes through their individual tax returns. Of utmost importance is that fact that the 20% deduction under section 199A on pass-through entities must be “qualified business income” (QBI); QBI is, of course, also subject to certain limits and restrictions. It also would be strictly prohibited for any individual in a service business unless that taxpayer’s taxable income is less than $315,000 for a joint return and less than $157,500 for an individual filer.

Entertainment Expense Deductions:

The tax overhaul was the elimination of the 50 percent entertainment tax deduction that firms had long been able to take on business-related expenses for “entertainment, amusement, or recreation.” So maybe wondering what are the deductibility rules for various meal expenses?

- Taking a client to dinner? 50 percent

- Lunch & learn (internal & external)? 50 percent

- Working dinner for employees? 50 percent (none after 2025)

- Traveling employee? 50 percent

- Office holiday party? 100 percent

- Meal served in luxury booth at the stadium? None

New Limits On Deducting Business Interest Expense:

The new tax reform limits the ability for many businesses to claim and deduct it’s interest expense paid or accrued, the new rule does not allow interest deductions to the extent net interest expense exceeds an adjusted earnings-based threshold. So most small to medium sized companies this will not affect them.

There are basically five categories of taxpayers that can avoid the new rules:

- Any business with average gross receipts over the prior three years of less than $25 million,

- An employee,

- The business of furnishing or selling certain types of energy,

- An electing farming business, or

- An electing real property trade or business.

Section 179 expensing:

The Act almost doubles the maximum amount a taxpayer may expense under section 179 to from $510,000 to $1,000,000 and increases the phase-out threshold amount to $2.5 million. The $1 million limitation is reduced (but not below zero) by the amount by which the cost of qualifying property placed in service during the taxable year exceeds $2.5 million. The $1 million and $2.5 million amounts, as well as the $25,000 sport utility vehicle limitation, are indexed for inflation for taxable years beginning after 2018.

The Act also expands the definition of qualified real property eligible for section 179 expensing to include any of the following improvements to nonresidential real property placed in service after the date such property was first placed in service: roofs; heating, ventilation and air-conditioning property; fire protection and alarm systems; and security systems.

Like-Kind Exchanges:

The law limits the applicability of the gain deferral rules to like-kind exchanges of real property, effective for exchanges completed after December 31, 2017. This

provision does not sunset.

Carried Interest:

The law will recharacterize certain gains of partnership interest from long-term to short-term capital gains to the extent such gains relate to property with a holding period not greater than three years, effective for tax years beginning

in 2018. This provision does not sunset.

Conclusion

In order for your company to be successful, you should consult with an accounting professional. The services of a highly rated CPA firm will allow you to rest easy because you will know that your business’ accounting processes are in reliable hands, and in strict compliance with applicable legislation and best practices. Use your valuable time to concentrate on building and bettering your business. Scott M. Aber, CPA is a small business accountant expert who can help your company achieve goals and forge forward along the path to success. Please contact our office for further information.